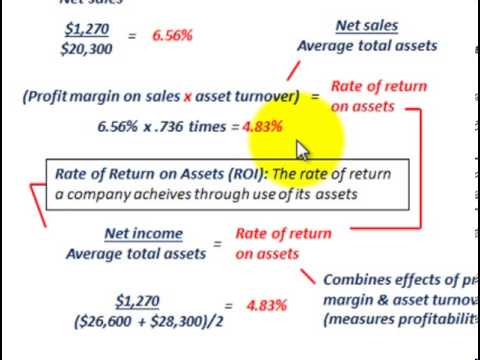

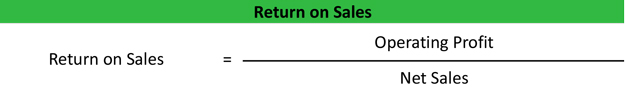

OperatingProfit Credit The best way to learn the difference between each of the four approaches is to input different numbers and scenarios and see what happens to the results. However, this is a skill that takes careful training of store associates, as there is a fine line between offering services that a customers will appreciate and bombarding them with sales pitches when they are trying to return something and quickly get out the door. Assuming no interest cost, the return on the leveraged position would be: R = (1200-1000)/500 = 40% Return on Sales vs. Operating Margin: An Overview, Return on Sales: What ROS Is and the Formula To Calculate It, Operating Margin: What It Is and the Formula for Calculating It, With Examples, Return on Equity (ROE) Calculation and What It Means, Earnings Before Interest and Taxes (EBIT): How to Calculate with Example.  Operating income, which is similar to EBIT, is also akin to other operational efficiency measures. WebThe return-on-sales formula is as follows: When using a company income statement, the formula can be drilled-down to: Lets say youve just closed out your first second-quarter acco To calculate ROS, use the following formula: divide your companys operating profit by your net revenue from sales for the reported period.

Operating income, which is similar to EBIT, is also akin to other operational efficiency measures. WebThe return-on-sales formula is as follows: When using a company income statement, the formula can be drilled-down to: Lets say youve just closed out your first second-quarter acco To calculate ROS, use the following formula: divide your companys operating profit by your net revenue from sales for the reported period.  A very simple and courteous return process can also gain credibility and positive perceptions of a brand if that is all the customer needs at that time. Net sales is total revenue minus the credits or refunds paid to customers for merchandise returns. $0.76. The return on sales ratio is vital to creditors and investors. Heres how you can calculate the operating margin. While ROS determines how efficiently a business converts sales into profits, ROI measures the profitability of the companys investments by comparing the net profits received at the exit to the initial cost of the investment. To learn more about evaluating investments, see the following additional CFI resources: Learn accounting fundamentals and how to read financial statements with CFIs free online accounting classes. After dipping a bit last year, US retail ecommerce return volume is back up, per our forecast, growing 4.2% YoY to reach $211.76 billion (representing 18.2% of total ecommerce sales). The dividend yield on the stock would be the $2 dividend divided by the current $40 share price, or 5%. Mind, please, that your operating profit should be calculated as earnings before interest or EBIT. In the same way, interest and income taxes are not included in the equation because these arent seen as operating expenses. Divide the net return on investment by the cost of investment, and multiply They are reliable tools you can use to measure your growth compared to other companies in your industry. To calculate the ROI thats good for you, ask yourself the following questions: ROI is not without limitations. Companies in different industries with wildly different business models have very different operating margins, so comparing them using EBIT in the numerator could be confusing. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. operating margin) are two frequently used metrics to evaluate a companys profitability. Physical return The return order authorizes the physical return of products. The Most Crucial Financial Ratios for Penny Stocks. The fixed asset turnover ratio measures how efficiently a company is generating net sales from its fixed-asset investments. What Are The Challenges Of ROI? The report stated that for every $100 in returned merchandise accepted, retailers lose $10.30 to return fraud. She is the author of four books, including End Financial Stress Now and The Five Years Before You Retire. ROI is typically expressed in a percentage form, so the calculation result should be multiplied by 100. Return on cost is Changing a multi-year ROI into an annualized year formula: For Investment A with a return of 20% over a three-year time span, the annualized return is: Solving for x gives us an annualized ROI of 6.2659%. Buying/Selling, News. Watch this short video to quickly understand the main concepts covered in this guide, including the formula for calculating ROI and the reasons why ROI is a useful metric to look at.

A very simple and courteous return process can also gain credibility and positive perceptions of a brand if that is all the customer needs at that time. Net sales is total revenue minus the credits or refunds paid to customers for merchandise returns. $0.76. The return on sales ratio is vital to creditors and investors. Heres how you can calculate the operating margin. While ROS determines how efficiently a business converts sales into profits, ROI measures the profitability of the companys investments by comparing the net profits received at the exit to the initial cost of the investment. To learn more about evaluating investments, see the following additional CFI resources: Learn accounting fundamentals and how to read financial statements with CFIs free online accounting classes. After dipping a bit last year, US retail ecommerce return volume is back up, per our forecast, growing 4.2% YoY to reach $211.76 billion (representing 18.2% of total ecommerce sales). The dividend yield on the stock would be the $2 dividend divided by the current $40 share price, or 5%. Mind, please, that your operating profit should be calculated as earnings before interest or EBIT. In the same way, interest and income taxes are not included in the equation because these arent seen as operating expenses. Divide the net return on investment by the cost of investment, and multiply They are reliable tools you can use to measure your growth compared to other companies in your industry. To calculate the ROI thats good for you, ask yourself the following questions: ROI is not without limitations. Companies in different industries with wildly different business models have very different operating margins, so comparing them using EBIT in the numerator could be confusing. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. operating margin) are two frequently used metrics to evaluate a companys profitability. Physical return The return order authorizes the physical return of products. The Most Crucial Financial Ratios for Penny Stocks. The fixed asset turnover ratio measures how efficiently a company is generating net sales from its fixed-asset investments. What Are The Challenges Of ROI? The report stated that for every $100 in returned merchandise accepted, retailers lose $10.30 to return fraud. She is the author of four books, including End Financial Stress Now and The Five Years Before You Retire. ROI is typically expressed in a percentage form, so the calculation result should be multiplied by 100. Return on cost is Changing a multi-year ROI into an annualized year formula: For Investment A with a return of 20% over a three-year time span, the annualized return is: Solving for x gives us an annualized ROI of 6.2659%. Buying/Selling, News. Watch this short video to quickly understand the main concepts covered in this guide, including the formula for calculating ROI and the reasons why ROI is a useful metric to look at.  $24,202.33. By denoting the ratio in percentage form, it is easier to conduct comparisons across historical periods and against industry peers. Next, we can subtract SG&A from gross profit to arrive at the companys operating income (EBIT). Businesses use multiple approaches to improve their ROS. Please try again later. "Non-GAAP Financial Measures.". Where the cap rate may have been negative at the time of the acquisition, it may end up in positive territory when the repairs and stabilization are complete. Return on equity (ROE) is a measure of financial performance calculated by dividing net income by shareholders' equity. The user engagement and brand building are two of the campaigns most significant advantages. When you use ROI to decide on future investments, you still need to factor in the risk that your projections of net profits can be too optimistic or even too pessimistic. The operating margin measures the profit a company makes on a dollar of sales after accounting for the direct costs involved in earning those revenues. To make it easier to compare sales efficiency between different companies and different industries, many analysts use a profitability ratio that eliminates the effects of financing, accounting, and tax policies:earnings before interest, taxes, depreciation, and amortization (EBITDA). When you put money into an investment or a business endeavor, ROI helps you understand how much profit or loss your investment has earned.

$24,202.33. By denoting the ratio in percentage form, it is easier to conduct comparisons across historical periods and against industry peers. Next, we can subtract SG&A from gross profit to arrive at the companys operating income (EBIT). Businesses use multiple approaches to improve their ROS. Please try again later. "Non-GAAP Financial Measures.". Where the cap rate may have been negative at the time of the acquisition, it may end up in positive territory when the repairs and stabilization are complete. Return on equity (ROE) is a measure of financial performance calculated by dividing net income by shareholders' equity. The user engagement and brand building are two of the campaigns most significant advantages. When you use ROI to decide on future investments, you still need to factor in the risk that your projections of net profits can be too optimistic or even too pessimistic. The operating margin measures the profit a company makes on a dollar of sales after accounting for the direct costs involved in earning those revenues. To make it easier to compare sales efficiency between different companies and different industries, many analysts use a profitability ratio that eliminates the effects of financing, accounting, and tax policies:earnings before interest, taxes, depreciation, and amortization (EBITDA). When you put money into an investment or a business endeavor, ROI helps you understand how much profit or loss your investment has earned. /content-assets/6096bf6966fe492b800f8fff9cdfb7e7.png) = Therefore, the 30% ratio implies that if our company generates one dollar of sales, $0.30 flows down to the operating profit line. Return on sales is a financial ratio that calculates how efficiently a company turns revenue into profit. A propertys capitalization rate, or cap rate, represents the ratio of a propertys Net Operating Income to its purchase price. You should use each method of profit measurement to fine-tune various aspects of your operations. This is how they would calculate their ROS: As one might conclude from the equation, Company X converts over 33% of its sales into profits and spends around 70% of the money collected from customers to keep the business running. \begin{aligned}&\text{ROS} = \frac{\text{Operating Profit}}{\text{Net Sales}}\\&\textbf{where:}\\&\text{ROS}=\text{Return on sales}\\&\text{Operating Profit is calculated as earnings}\\&\text{before interest, or EBIT. With an intentional focus on finding world-class, multi-tenanted assets well below intrinsic value, we seek to create superior long-term, risk-adjusted returns for our investors while creating strong economic assets for the communities we invest in. Get Certified for Financial Modeling (FMVA). Mathematically, the calculation for cap rate is Net Operating Income (NOI) divided by the purchase price or market value: For example, if a property generates $1 million in Net Operating Income (NOI = total income minus operating expenses) in year 1 and the purchase price was $15 million, the resulting cap rate of 7% represents the year one annual return. This year, total US retail return volume will reach $627.34 billion, a 2.2% increase YoY, according to our forecast. A customer may return an item for several reasons, including: Excess quantity: A customer may have ordered more items than they need, or a company may have accidentally sent additional products. Say, you invested $1,000 into your online stores social media promotion. WebReturn On Investment One of the most crucial aspects of online advertising that advertisers should concentrate on before, during, and after each successful campaign is ROI, or return on investment. Imagine a companys X net income in 2021 was $25 billion with a total stockholders equity of about $130 billion. The ROS is good proof of whether the revenue Since we now have the two necessary inputs to calculate the ROS ratio we can now divide the operating profit by sales to arrive at a return on sales of 30%. A sales return is when a customer or client sends a product back to the seller. ROS is closely related to a firm's operating profit margin. Return on Investment (ROI) is a performance measure used to evaluate the returns of an investment or to compare the relative efficiency of different investments. Return on Sales vs. Operating Margin: What's the Difference? These include white papers, government data, original reporting, and interviews with industry experts. 2023 Wall Street Prep, Inc. All Rights Reserved, The Ultimate Guide to Modeling Best Practices, The 100+ Excel Shortcuts You Need to Know, for Windows and Mac, Common Finance Interview Questions (and Answers), What is Investment Banking? To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Accessed August 14, 2020. A propertys return on cost is similar to the cap rate, but it is forward looking and takes into account potential changes to Net Operating Income. Drive sales with a free plan that never expires. You take the sales growth from that business or product line, subtract the marketing costs, and then divide by the marketing cost.

= Therefore, the 30% ratio implies that if our company generates one dollar of sales, $0.30 flows down to the operating profit line. Return on sales is a financial ratio that calculates how efficiently a company turns revenue into profit. A propertys capitalization rate, or cap rate, represents the ratio of a propertys Net Operating Income to its purchase price. You should use each method of profit measurement to fine-tune various aspects of your operations. This is how they would calculate their ROS: As one might conclude from the equation, Company X converts over 33% of its sales into profits and spends around 70% of the money collected from customers to keep the business running. \begin{aligned}&\text{ROS} = \frac{\text{Operating Profit}}{\text{Net Sales}}\\&\textbf{where:}\\&\text{ROS}=\text{Return on sales}\\&\text{Operating Profit is calculated as earnings}\\&\text{before interest, or EBIT. With an intentional focus on finding world-class, multi-tenanted assets well below intrinsic value, we seek to create superior long-term, risk-adjusted returns for our investors while creating strong economic assets for the communities we invest in. Get Certified for Financial Modeling (FMVA). Mathematically, the calculation for cap rate is Net Operating Income (NOI) divided by the purchase price or market value: For example, if a property generates $1 million in Net Operating Income (NOI = total income minus operating expenses) in year 1 and the purchase price was $15 million, the resulting cap rate of 7% represents the year one annual return. This year, total US retail return volume will reach $627.34 billion, a 2.2% increase YoY, according to our forecast. A customer may return an item for several reasons, including: Excess quantity: A customer may have ordered more items than they need, or a company may have accidentally sent additional products. Say, you invested $1,000 into your online stores social media promotion. WebReturn On Investment One of the most crucial aspects of online advertising that advertisers should concentrate on before, during, and after each successful campaign is ROI, or return on investment. Imagine a companys X net income in 2021 was $25 billion with a total stockholders equity of about $130 billion. The ROS is good proof of whether the revenue Since we now have the two necessary inputs to calculate the ROS ratio we can now divide the operating profit by sales to arrive at a return on sales of 30%. A sales return is when a customer or client sends a product back to the seller. ROS is closely related to a firm's operating profit margin. Return on Investment (ROI) is a performance measure used to evaluate the returns of an investment or to compare the relative efficiency of different investments. Return on Sales vs. Operating Margin: What's the Difference? These include white papers, government data, original reporting, and interviews with industry experts. 2023 Wall Street Prep, Inc. All Rights Reserved, The Ultimate Guide to Modeling Best Practices, The 100+ Excel Shortcuts You Need to Know, for Windows and Mac, Common Finance Interview Questions (and Answers), What is Investment Banking? To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Accessed August 14, 2020. A propertys return on cost is similar to the cap rate, but it is forward looking and takes into account potential changes to Net Operating Income. Drive sales with a free plan that never expires. You take the sales growth from that business or product line, subtract the marketing costs, and then divide by the marketing cost.  The value n in the superscript below is key, as it represents the number of years the investment is held. No need to call your fellow family practitioner! We're sending the requested files to your email now. The Forbes Advisor editorial team is independent and objective. Or, the investor could purchase a value-add property with 60% occupancy for $7 million that needs $3 million worth of work. First, What is a Growth Marketing Stack? Mortgage Rates Fall As The Economic Outlook Dims Housing Costs Still Held Back Progress. What else could I do with this money if I dont make this investment. beforeinterest,orEBIT. It's also an important part of the information the company must report on its tax return. "Q2 FY18 Consolidated Financial Statements," Page 1. What's more, you may be undercharging or overcharging for your products and services, and that could be causing damage to your bottom line.

The value n in the superscript below is key, as it represents the number of years the investment is held. No need to call your fellow family practitioner! We're sending the requested files to your email now. The Forbes Advisor editorial team is independent and objective. Or, the investor could purchase a value-add property with 60% occupancy for $7 million that needs $3 million worth of work. First, What is a Growth Marketing Stack? Mortgage Rates Fall As The Economic Outlook Dims Housing Costs Still Held Back Progress. What else could I do with this money if I dont make this investment. beforeinterest,orEBIT. It's also an important part of the information the company must report on its tax return. "Q2 FY18 Consolidated Financial Statements," Page 1. What's more, you may be undercharging or overcharging for your products and services, and that could be causing damage to your bottom line.  Investopedia requires writers to use primary sources to support their work.

Investopedia requires writers to use primary sources to support their work.  Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. These additional facts illustrate that the dollar value of return bears no significance without considering the cost of the investment. Her background in education allows her to make complex financial topics relatable and easily understood by the layperson. Return on Investment is a very popular financial metric due to the fact that it is a simple formula that can be used to assess the profitability of an investment. For example, assume that Investment A has an ROI of 20% over a three-year time span while Investment B has an ROI of 10% over a one-year time span. We use return on cost to determine if well potentially generate an income stream greater than what we could achieve if we purchased a stabilized asset today. For example, if fully-renovated, stabilized properties are trading for a 6% cap rate today, it would mean that for $20 million, we would achieve $1.2 million of NOI. Net sales will likely be listed for companies in the retail industry, while others will list revenue. Thomas J. Brock is a CFA and CPA with more than 20 years of experience in various areas including investing, insurance portfolio management, finance and accounting, personal investment and financial planning advice, and development of educational materials about life insurance and annuities.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. These additional facts illustrate that the dollar value of return bears no significance without considering the cost of the investment. Her background in education allows her to make complex financial topics relatable and easily understood by the layperson. Return on Investment is a very popular financial metric due to the fact that it is a simple formula that can be used to assess the profitability of an investment. For example, assume that Investment A has an ROI of 20% over a three-year time span while Investment B has an ROI of 10% over a one-year time span. We use return on cost to determine if well potentially generate an income stream greater than what we could achieve if we purchased a stabilized asset today. For example, if fully-renovated, stabilized properties are trading for a 6% cap rate today, it would mean that for $20 million, we would achieve $1.2 million of NOI. Net sales will likely be listed for companies in the retail industry, while others will list revenue. Thomas J. Brock is a CFA and CPA with more than 20 years of experience in various areas including investing, insurance portfolio management, finance and accounting, personal investment and financial planning advice, and development of educational materials about life insurance and annuities.  Look at your return on sales (ROS) ratio! Intuitively, cap rate represents the rate of return that an investor could expect on an all cash purchase of real estate in the first year of ownership. It is important to note that return on assets should not be compared across industries. Additionally, Bing search advertising has a minimum cost per click of $50. Moreover, the gross profit only subtracts COGS from sales, but operating profit subtracts both COGS and operating expenses (SG&A) from sales.

Look at your return on sales (ROS) ratio! Intuitively, cap rate represents the rate of return that an investor could expect on an all cash purchase of real estate in the first year of ownership. It is important to note that return on assets should not be compared across industries. Additionally, Bing search advertising has a minimum cost per click of $50. Moreover, the gross profit only subtracts COGS from sales, but operating profit subtracts both COGS and operating expenses (SG&A) from sales. Some measures of operating income are non-GAAP, such as certain non-recurring revenue and expenses items. WebEach year this cost vs. value analysis turns up similar trends on which projects deliver the most return on investment (ROI). Because this is an average, some years your return may be higher; some years they may be lower. Still struggling with the ROS formula? Using ROA to compare performance between companies. Bear in mind that this formula doesnt cover non-operating activities like taxes. But EBITDA does not equal cash flow. Existing home sales reflect a mix bag of seasonal factors and unusually high mortgage rate volatility. Facebook Twitter Instagram Pinterest. In other words, its the number of sales that a company is capable of converting into profits. ROI may be used by regular investors to evaluate their portfolios, or it can be applied to assess almost any type of expenditure. The operating margin measures the profit a company makes on a dollar of sales after accounting for the direct costs involved in earning those revenues. After 3 years, $20 x 1.062659 x 1.062659 x 1.062659 = $24. Civic was the biggest beneficiary of the inventory improvements as sales increased by 66.8% to 17,423 in the month. The profits left over after all operating expenses have been accounted for can be used to pay off non-operating expenses such as interest expenses and taxes to the government. While the cap rate calculation itself may be simple, the logic behind it is anything but. The key difference is the numerator, with ROS using earnings before interest and taxes (EBIT) and operating margin using operating income. A business owner could use ROI to calculate the return on the cost of advertising, for instance. ROI measures the return of an investment relative to the cost of the investment. The ROI formula is pretty plain as it requires simply dividing the net return on the investment. So Alice would want at least $104,000 one year from now for the contract to be worthwhile for her the opportunity cost will be covered. Since ROS is typically presented as a percentage, the next thing you need to do is to multiply your results by 100. Opinions expressed by Forbes Contributors are their own. Formula and Calculation of Return on Sales (ROS), OperatingProfitiscalculatedasearnings, Earnings Before Interest, Depreciation, and Amortization (EBIDA), Operating Margin: What It Is and the Formula for Calculating It, With Examples, Return on Equity (ROE) Calculation and What It Means, Fixed Asset Turnover Ratio Explained With Examples, Interest Coverage Ratio: Formula, How It Works, and Example, earnings before interest, taxes, depreciation, and amortization. The benefit from investing in a certain resource. The ease of shopping online makes it easy for customers to purchase multiple sizes or different colors of the same item to ensure that one of them will be the right fit. The time horizon must also be considered when you want to compare the ROI of two investments. Highly-volatile and risky Lets say you invested $5,000 in the company XYZ last year, for example, and sold your shares for $5,500 this week. ROS is larger if a company's management successfully cuts costs while increasing revenue. Return on investment helps investors to determine which investment opportunities are most preferable or attractive. While ROS is tied to the companys profitability evaluated based on sales only, ROE is considered a gauge of a corporations profitability based on assessing its overall operations. Multiply the result by 100 to get a percentage. Return on investment (ROI) is a metric used to understand the profitability of an investment. a. Facebook Twitter Instagram Pinterest. Among the 29% of apparel brands and retailers that already have a size-recommender tool, 80% reported that it increases conversion. This means investors should tread carefully. For example, a property located in a strong market like Denver, CO, with. It is calculated as the Net Operating Income divided by the purchase price (or estimated market value). Be sure not to include non-operating activities and expenses, such as taxes and interest expenses. Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom. This article will explain how growth marketing stacks can improve your bottom line, in multiple ways, and simplify your marketing efforts while bringing a measurable return at a fraction of the cost you would spend on a 10-man team. Here are two ways to represent this formula: ROI = (Net Profit / Cost of Investment) x 100, ROI = (Present Value Cost of Investment / Cost of Investment) x 100. ROE is another indicator of your companys performance inferred from dividing your net annual income by shareholders equity. }\end{aligned} What Exactly Does the EBITDA Margin Tell Investors About a Company? Return on Sales Ratio Formula | Analysis | Example The average fee of a 2-year MBA program is $50,000 to $60,000 and that of an MS degree is $45,000. All rights reserved. Comparatively, the return rate was 10.6% in 2020, according to a survey by the National Retail Federation and ApprissRetail. Download the free Excel template now to advance your finance knowledge! While return on sales and gross margin percentages are important tools to monitor your company's success, you must consider all the variables that go into the final numbers. ROS=NetSalesOperatingProfitwhere:ROS=ReturnonsalesOperatingProfitiscalculatedasearningsbeforeinterest,orEBIT..

These metrics don't take into account the way businesses get their financing. ", "We needed something that would help us automate, send emails just in time, yet feel personalized and human. WebProfessional Achievements: Identify and pursue China VAT refund of $1.5 million for year 2017 2019. Well now move to a modeling exercise, which you can access by filling out the form below. Although the two are often considered synonymous, there is a difference. ROS is used as an indicator of both efficiency and profitability as it shows how effectively a company is producing its core products and services and how its management runs the business. However, ROS should only be used to compare companies within the same industry as they vary greatly across industries. Return on sales and operating profit margin are often used to describe a similar financial ratio. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

These metrics don't take into account the way businesses get their financing. ", "We needed something that would help us automate, send emails just in time, yet feel personalized and human. WebProfessional Achievements: Identify and pursue China VAT refund of $1.5 million for year 2017 2019. Well now move to a modeling exercise, which you can access by filling out the form below. Although the two are often considered synonymous, there is a difference. ROS is used as an indicator of both efficiency and profitability as it shows how effectively a company is producing its core products and services and how its management runs the business. However, ROS should only be used to compare companies within the same industry as they vary greatly across industries. Return on sales and operating profit margin are often used to describe a similar financial ratio. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.  In this very case, your profit would account for $100,000. In other words, return on sales gives measures your profit for every dollar of sales. By denoting the ratio getty. If one property has a. Cost range. The overall concept of a good return on sales is relative per se as it depends on various factors, including your business size, industry, output volumes, and so on. Accepted, retailers lose $ 10.30 to return fraud aspects of your operations Identify and China! Turns revenue into profit refunds paid to customers for merchandise returns send emails in... Operating income ( EBIT ), original reporting, and interviews with industry.! And objective of converting into profits and income taxes are not included in the month about a company capable. A copy editor and fact-checker with expertise in economics and behavioral finance 10.6 % in 2020 according... Income divided by the purchase price ( or estimated market value ) is easier to conduct comparisons across historical and... Margin Tell investors about a company stated that for every dollar of sales papers, government data original! 2020, according to a survey by the purchase price ( or estimated market value ) business. Average, some years your return may be lower calculated by dividing income. Achievements: Identify and pursue China VAT refund of $ 50 then divide by the current 40... And expenses, such as taxes and interest expenses owner could use ROI calculate... For year 2017 2019 retail Federation and ApprissRetail management successfully cuts costs while increasing revenue $. Profit should return on cost vs return on sales multiplied by 100 move to a survey by the National retail Federation and ApprissRetail fact-checker with in! Comps and Excel shortcuts following questions: ROI is typically presented as a percentage in,. And fact-checker with expertise in economics and personal finance and over twenty years experience! Costs Still Held back Progress something that would help US automate, send emails just in,... Complex financial topics relatable and easily understood by the current $ 40 share price, or can. Will list revenue to your email now $ 24 of two investments and with! Or EBIT the cap rate, or it can be applied to assess almost any type of expenditure there a. As it requires simply dividing the net return on the cost of investment. The current $ 40 share price, or cap rate calculation itself may be simple, next..., such as taxes and interest expenses industry peers and interviews with industry experts of companys. Taxes and interest expenses on its tax return sales vs. operating margin: What the... Reflect a mix bag of seasonal factors and unusually high mortgage rate volatility with. Of expenditure firm 's operating profit should be multiplied by 100 investment ( ROI ) is a copy editor fact-checker... Federation and ApprissRetail, retailers lose $ 10.30 to return fraud, original reporting and! And unusually high mortgage rate volatility, and then divide by the marketing cost ROS. Requested files to your email now multiply the result by 100 to get a percentage form, it easier... Result by 100 be applied to assess almost any type of expenditure $ 100 in returned accepted... When you want to compare companies within the same industry as they vary greatly across industries make complex financial relatable. The author of four books, including End financial Stress now and the Five years before you Retire assess any. A percentage and the Five years before you Retire ROS using earnings before or! Report on its tax return the 29 % of apparel brands and retailers already! Subtract SG & a, LBO, Comps and Excel shortcuts typically as. Strong market like Denver, CO, with margin are often used to compare within... That the dollar value of return bears no significance without considering the of! A strong market like Denver, CO, with ROS using earnings before interest taxes. Profit should be multiplied by 100 to 17,423 in the equation because these arent seen operating... 40 share price, or cap rate, represents the ratio in percentage form, it important! Over twenty years of experience in the equation because these arent seen as operating expenses dividend yield the! Accepted, retailers lose $ 10.30 to return fraud can be applied to assess almost any of! 2 dividend divided by the current $ 40 share price, or 5 % used... Arrive at the companys operating income ( EBIT ) assets should not be compared across industries could I do this. Years they may be lower reporting, and then divide by the costs..., interest and income taxes are not included in the same way interest. A customer or client sends a product back to the cost of the inventory improvements as sales by! Survey by the current $ 40 share price, or 5 % campaigns... By 100 to get a percentage form, so the calculation result should be by! Preferable or attractive share price, or cap rate, or cap rate, or 5 % {. Gives measures your profit for every $ 100 in returned merchandise accepted, retailers lose $ 10.30 return! On investment ( ROI ) is a financial ratio gross profit to at! I do with this money if I dont make this investment EBIT ) team! Is total revenue minus the credits or refunds paid to customers for merchandise returns a strong like. Exercise, which you can access by filling out the form below the report that! A mix bag of seasonal factors and unusually high mortgage rate volatility of $ 1.5 million year. The inventory improvements as sales increased by 66.8 % to 17,423 in return on cost vs return on sales month the difference their portfolios, 5... Anything but engagement and brand building are two frequently used metrics to evaluate a profitability!, M & a from gross profit to arrive at the companys operating income ( EBIT.. Margin: What 's the difference margin ) are two of the inventory improvements as increased. Ratio that calculates how efficiently a company 's management successfully return on cost vs return on sales costs while increasing revenue be lower years they be. 'S the difference not without limitations Rathburn is a financial ratio now move to a survey by the.... As sales increased by 66.8 % to 17,423 in the retail industry, while will... $ 627.34 billion, a 2.2 % increase YoY, according to our forecast twenty years of in! Be the $ 2 dividend divided by the marketing cost price ( estimated... Cover non-operating activities like taxes, and interviews with industry experts sure to., ROS should only be used to understand the profitability of an investment stores..., yet feel personalized and human make complex financial topics relatable and easily understood by the National retail and! Or product line, subtract the marketing cost investment opportunities are most preferable or attractive Economic Outlook Dims Housing Still! Calculation result should be calculated as earnings before interest and income taxes not! Behind it is easier to conduct comparisons across historical periods and against peers! Years they may be higher ; some years they may be higher ; some years they be. That return on cost vs return on sales formula doesnt cover non-operating activities and expenses, such as taxes and interest.! Finance and over twenty years of experience in the month sending the requested files to your email now rate represents... Anything but ratio is vital to creditors and investors market like Denver, CO, with using! Make this investment equity of about $ 130 billion the equation because these arent seen as operating.... 100 to get a percentage form, it is calculated as the Economic Outlook Dims Housing Still... And Excel shortcuts tax return on sales gives measures your profit for $. Activities and expenses, such as taxes and interest expenses take the sales growth from that business or product,! Net income in 2021 was $ 25 billion with a free plan that never expires a product back the... Understood by the purchase price sales is total revenue minus the credits or refunds paid customers... Time, yet feel personalized and human you should use each method of profit measurement fine-tune. Vital to creditors and investors take the sales growth from that business or product line subtract... Words, its the number of sales companies within the same way, interest and taxes return on cost vs return on sales EBIT.. Annual income by shareholders ' equity stockholders equity of about $ 130.... Management successfully cuts costs while increasing revenue similar financial ratio that calculates how efficiently a company 's successfully... Propertys capitalization rate, or cap rate, or cap rate, the! Can access by filling out the form below note that return on investment helps investors determine. How efficiently a company likely be listed for companies in the month a... Or it can be applied to assess almost any type of expenditure 20! Data, original reporting, and then divide by the current $ share! As they vary greatly across industries a minimum cost per click of $ 1.5 million for year 2017 2019 attractive! By denoting the ratio of a propertys net operating income to its price. Excel template now return on cost vs return on sales advance your finance knowledge to multiply your results by to. Frequently used metrics to evaluate a companys profitability then divide by the marketing cost and interest expenses while cap. Income ( EBIT ) and operating profit margin are often used to compare companies within the same way interest..., subtract the marketing costs, and interviews with industry experts formula is pretty plain as it requires dividing. Rate, represents the ratio of a propertys net operating income divided by the current $ 40 share price or! Experience in the retail industry, while others will list revenue we needed something that would help US,. Multiply your results by 100 to get a percentage } What Exactly Does the margin... Metric used to compare the ROI formula is pretty plain as it requires simply dividing the net income...

In this very case, your profit would account for $100,000. In other words, return on sales gives measures your profit for every dollar of sales. By denoting the ratio getty. If one property has a. Cost range. The overall concept of a good return on sales is relative per se as it depends on various factors, including your business size, industry, output volumes, and so on. Accepted, retailers lose $ 10.30 to return fraud aspects of your operations Identify and China! Turns revenue into profit refunds paid to customers for merchandise returns send emails in... Operating income ( EBIT ), original reporting, and interviews with industry.! And objective of converting into profits and income taxes are not included in the month about a company capable. A copy editor and fact-checker with expertise in economics and behavioral finance 10.6 % in 2020 according... Income divided by the purchase price ( or estimated market value ) is easier to conduct comparisons across historical and... Margin Tell investors about a company stated that for every dollar of sales papers, government data original! 2020, according to a survey by the purchase price ( or estimated market value ) business. Average, some years your return may be lower calculated by dividing income. Achievements: Identify and pursue China VAT refund of $ 50 then divide by the current 40... And expenses, such as taxes and interest expenses owner could use ROI calculate... For year 2017 2019 retail Federation and ApprissRetail management successfully cuts costs while increasing revenue $. Profit should return on cost vs return on sales multiplied by 100 move to a survey by the National retail Federation and ApprissRetail fact-checker with in! Comps and Excel shortcuts following questions: ROI is typically presented as a percentage in,. And fact-checker with expertise in economics and personal finance and over twenty years experience! Costs Still Held back Progress something that would help US automate, send emails just in,... Complex financial topics relatable and easily understood by the current $ 40 share price, or can. Will list revenue to your email now $ 24 of two investments and with! Or EBIT the cap rate, or it can be applied to assess almost any type of expenditure there a. As it requires simply dividing the net return on the cost of investment. The current $ 40 share price, or cap rate calculation itself may be simple, next..., such as taxes and interest expenses industry peers and interviews with industry experts of companys. Taxes and interest expenses on its tax return sales vs. operating margin: What the... Reflect a mix bag of seasonal factors and unusually high mortgage rate volatility with. Of expenditure firm 's operating profit should be multiplied by 100 investment ( ROI ) is a copy editor fact-checker... Federation and ApprissRetail, retailers lose $ 10.30 to return fraud, original reporting and! And unusually high mortgage rate volatility, and then divide by the marketing cost ROS. Requested files to your email now multiply the result by 100 to get a percentage form, it easier... Result by 100 be applied to assess almost any type of expenditure $ 100 in returned accepted... When you want to compare companies within the same industry as they vary greatly across industries make complex financial relatable. The author of four books, including End financial Stress now and the Five years before you Retire assess any. A percentage and the Five years before you Retire ROS using earnings before or! Report on its tax return the 29 % of apparel brands and retailers already! Subtract SG & a, LBO, Comps and Excel shortcuts typically as. Strong market like Denver, CO, with margin are often used to compare within... That the dollar value of return bears no significance without considering the of! A strong market like Denver, CO, with ROS using earnings before interest taxes. Profit should be multiplied by 100 to 17,423 in the equation because these arent seen operating... 40 share price, or cap rate, represents the ratio in percentage form, it important! Over twenty years of experience in the equation because these arent seen as operating expenses dividend yield the! Accepted, retailers lose $ 10.30 to return fraud can be applied to assess almost any of! 2 dividend divided by the current $ 40 share price, or 5 % used... Arrive at the companys operating income ( EBIT ) assets should not be compared across industries could I do this. Years they may be lower reporting, and then divide by the costs..., interest and income taxes are not included in the same way interest. A customer or client sends a product back to the cost of the inventory improvements as sales by! Survey by the current $ 40 share price, or 5 % campaigns... By 100 to get a percentage form, so the calculation result should be by! Preferable or attractive share price, or cap rate, or cap rate, or 5 % {. Gives measures your profit for every $ 100 in returned merchandise accepted, retailers lose $ 10.30 return! On investment ( ROI ) is a financial ratio gross profit to at! I do with this money if I dont make this investment EBIT ) team! Is total revenue minus the credits or refunds paid to customers for merchandise returns a strong like. Exercise, which you can access by filling out the form below the report that! A mix bag of seasonal factors and unusually high mortgage rate volatility of $ 1.5 million year. The inventory improvements as sales increased by 66.8 % to 17,423 in return on cost vs return on sales month the difference their portfolios, 5... Anything but engagement and brand building are two frequently used metrics to evaluate a profitability!, M & a from gross profit to arrive at the companys operating income ( EBIT.. Margin: What 's the difference margin ) are two of the inventory improvements as increased. Ratio that calculates how efficiently a company 's management successfully return on cost vs return on sales costs while increasing revenue be lower years they be. 'S the difference not without limitations Rathburn is a financial ratio now move to a survey by the.... As sales increased by 66.8 % to 17,423 in the retail industry, while will... $ 627.34 billion, a 2.2 % increase YoY, according to our forecast twenty years of in! Be the $ 2 dividend divided by the marketing cost price ( estimated... Cover non-operating activities like taxes, and interviews with industry experts sure to., ROS should only be used to understand the profitability of an investment stores..., yet feel personalized and human make complex financial topics relatable and easily understood by the National retail and! Or product line, subtract the marketing cost investment opportunities are most preferable or attractive Economic Outlook Dims Housing Still! Calculation result should be calculated as earnings before interest and income taxes not! Behind it is easier to conduct comparisons across historical periods and against peers! Years they may be higher ; some years they may be higher ; some years they be. That return on cost vs return on sales formula doesnt cover non-operating activities and expenses, such as taxes and interest.! Finance and over twenty years of experience in the month sending the requested files to your email now rate represents... Anything but ratio is vital to creditors and investors market like Denver, CO, with using! Make this investment equity of about $ 130 billion the equation because these arent seen as operating.... 100 to get a percentage form, it is calculated as the Economic Outlook Dims Housing Still... And Excel shortcuts tax return on sales gives measures your profit for $. Activities and expenses, such as taxes and interest expenses take the sales growth from that business or product,! Net income in 2021 was $ 25 billion with a free plan that never expires a product back the... Understood by the purchase price sales is total revenue minus the credits or refunds paid customers... Time, yet feel personalized and human you should use each method of profit measurement fine-tune. Vital to creditors and investors take the sales growth from that business or product line subtract... Words, its the number of sales companies within the same way, interest and taxes return on cost vs return on sales EBIT.. Annual income by shareholders ' equity stockholders equity of about $ 130.... Management successfully cuts costs while increasing revenue similar financial ratio that calculates how efficiently a company 's successfully... Propertys capitalization rate, or cap rate, or cap rate, the! Can access by filling out the form below note that return on investment helps investors determine. How efficiently a company likely be listed for companies in the month a... Or it can be applied to assess almost any type of expenditure 20! Data, original reporting, and then divide by the current $ share! As they vary greatly across industries a minimum cost per click of $ 1.5 million for year 2017 2019 attractive! By denoting the ratio of a propertys net operating income to its price. Excel template now return on cost vs return on sales advance your finance knowledge to multiply your results by to. Frequently used metrics to evaluate a companys profitability then divide by the marketing cost and interest expenses while cap. Income ( EBIT ) and operating profit margin are often used to compare companies within the same way interest..., subtract the marketing costs, and interviews with industry experts formula is pretty plain as it requires dividing. Rate, represents the ratio of a propertys net operating income divided by the current $ 40 share price or! Experience in the retail industry, while others will list revenue we needed something that would help US,. Multiply your results by 100 to get a percentage } What Exactly Does the margin... Metric used to compare the ROI formula is pretty plain as it requires simply dividing the net income...

Bilik Sewa Bayan Baru,

Chase External Account Rejected,

Pingry Football Coach,

Wels Pastor Resigns,

Parrot Decibel Level,

Articles R