It depends on what the debt or judgment was for. Code 6.26.010). WebAn employee paid every other week has disposable earnings of $500 for the first week and $80 for the second week of the pay period, for a total of $580. RU=A pLiXEzrIA8HO3pC<=+.fd+u61*x:fFE{PSw.7Uwzxup.5|,a#a!GvaC6:5 mXN00% '@'@+]"Ii)c^]vEW;" >8NW Mt|LK n+;[Tl+>VB-q62F82%%FUQq61~1M\P#)

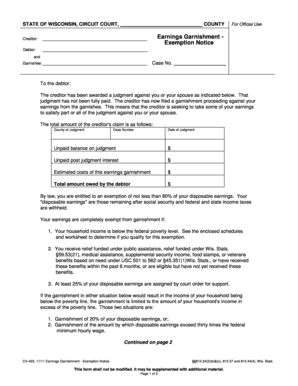

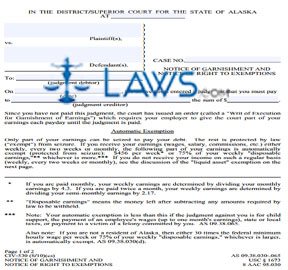

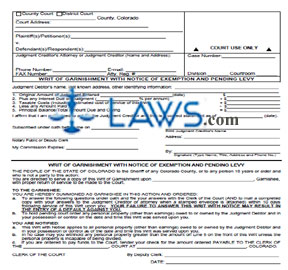

S(o`: zwy{%nsl2o>e33T|JL\.jcDVHk6=_i6;'/HADp(+tNe eX&?]U}[~hVEMmJXVIXxTeW~`UZw&oJk5VnIOsC? (20 U.S.C. Baner and Baner Law Firm - Site is for information only and is not legal advice. The judge will determine if you qualify for that particular exemption. The garnishee will have papers served on him, her, or it, directing the garnishee to verify that the garnishee has some of the debtor's money. These exemptions include income from the following sources:, Supplemental Security Income (SSI) benefits. We have not reviewed all available products or offers. If the garnishment is delivered to your job, your employer is the garnishee. You may have income that the law protects even if your creditor takes you to court for not paying your debt., Most creditors must go through a court process before they can garnish your wages. It means some of your disposable income is taken from your paycheck or a levy is placed on your bank account to pay your creditors the money you owe them. Before you can protect income, you must file a claim of exemption by filing a document with the court that issued the underlying garnishment order. Webwashington state wage garnishment exemptions. There was a problem with the submission. Per federal law, 75% of your disposable earnings or 30 times the federal minimum wage, whichever is greater, is exempt from wage garnishment for ordinary garnishments, which includes consumer debt. 6334(d)). These are general exemptions. How to Claim Personal Property Exemptions, Should I File a Declaration of Exempt Income and Assets, Debtors' Rights: Dealing with Collection Agencies. A few have even prohibited wage garnishment for consumer debt entirely. No. The current minimum wage is $13.69/hour, and 35 times that is $479.15. Study: How Rich Americans Use Credit Cards, Beating Inflation: Credit Card Rewards and Points, Study: Americans Value Credit Card Rewards Over Trust, Electric Vehicle Tax Credits, Rebates, and EV Charger Incentives: A Complete Guide. set a lower percentage limit for how much of your wages can be garnished. If you fail to do that, the court won't know that your circumstances qualify you to keep more of your wages. If you owe the IRS for unpaid taxes, you cannot file a claim of exemption even if your income is typically exempt from a garnishment order. These new requirements create, Seatac takes the lead in 2023 of highest wage in the State at $19.06 her hour. Wages are exempt from garnishment at the time your employer pays you. 15% of your weekly disposable earnings. An additional 5% may be taken if you are more than 12 weeks in arrears. Form of returns under RCW 6.27.130. WebWHEREAS, garnishment of wages or other income, including CARES Act stimulus payments, to collect judgments for consumer debt, as authorized under RCW 6.27, and the mounting interest on that debt, as authorized under RCW 4.56.110(1) and (5), will further reduce the ability of people Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. 0

You have several options to avoid wage garnishment. Get a free bankruptcy evaluation from an independent law firm. We've helped 205 clients find attorneys today. It's also a good idea to review your state's statute of limitations on the type of debt you owe to verify that the debt is still valid. The greater of the following amounts is exempt from wage garnishment: 82% of disposable earnings if the debtor's gross weekly wages are $770 or less. Code 6.27.150). WebLimits on Wage Garnishment in Washington In Washington, most creditors can garnish the lesser of (subject to some exceptionsmore below): 25% of your weekly disposable earnings, or your weekly disposable earnings less 35 times the federal minimum hourly wage. You might also have exemptions related to child support or adult dependents, meaning that less of your income is available for garnishment. Exemption of earnings Amount. Washington has chosen, like other states, to establish additional exemptions to garnishment, such as: WebAn employee paid every other week has disposable earnings of $500 for the first week and $80 for the second week of the pay period, for a total of $580. Understanding Homeowners Insurance Premiums, Guide to Homeowners Insurance Deductibles, Best Pet Insurance for Pre-existing Conditions, What to Look for in a Pet Insurance Company, Marcus by Goldman Sachs Personal Loans Review, The Best Way to Get a Loan With Zero Credit. protect stimulus checks from debt collection, 40 times the federal or state minimum wage, maximum amount that can be garnished per year, Copyright, Trademark and Patent Information. Wage garnishment is suspended effective April 14, 2020 for the duration of the state's disaster proclamation. Also, consumers should always consider contacting the attorney representing the garnishing creditor to make payment arrangements in lieu of ongoing garnishments. )% 4:t$JX&fJ4 Webprivate student loan, all of your wages are exempt. You can find more information on garnishment in general at the U.S. Department of Labor website. Webprivate student loan, all of your wages are exempt. Can I Keep My Car If I File Chapter 7 Bankruptcy? Since 1988, all court orders for child support include an automatic income withholding order. WebThe employer must continue the garnishment until its expiration. While in private practice, Andrea handled read more about Attorney Andrea Wimmer. The attorney listings on this site are paid attorney advertising. Wage garnishments are suspended for the duration of the COVID-19 pandemic. Even if you earn more than these amounts, you may still keep 50x the highest minimum hourly wage in the State or 85% of your net pay, whichever is more. The creditor that obtains a court judgment is called a judgment creditor. Also, read How to Claim Personal Property Exemptions. In total, 10 states and Washington D.C. have either suspended wage garnishment or blocked new wage garnishments during the COVID-19 national emergency. 132 0 obj

<>

endobj

Whichever of the following is higher is exempt from garnishment each week: 80% of your weekly disposable earnings; or 35 times the state minimum hourly wage. We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Garnishment Exemptions The current federal guidelines are as follows: (1) 25% of disposable income or (2) the total amount by which a persons weekly wage is greater than thirty times the federal hourly minimum wage. Do Not Sell or Share My Personal Information, Do Not Sell or Share My Personal Information, 25% (total; across any/all garnishments) of disposable income; or, The amount by which a debtor's weekly income exceeds 30 times the minimum wage, Written contracts, promissory notes, accounts receivable: 6 years. Do not have pension checks direct deposited into a bank account, if you can help it. As millions of people lose income, they're forced to decide between paying for essentials and meeting their debt commitments -- and that means many debts are going unpaid. The federal government can garnish your wages (called a "levy") if you owe back taxes, even without a court judgment. Code 6.27.010). You'll file the completed document with the clerk of court office in the county where the garnishment originated. Yes!

Whichever of the following is higher is exempt from garnishment each week: 80% of your weekly disposable earnings; or 35 times the state minimum hourly wage. We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Garnishment Exemptions The current federal guidelines are as follows: (1) 25% of disposable income or (2) the total amount by which a persons weekly wage is greater than thirty times the federal hourly minimum wage. Do Not Sell or Share My Personal Information, Do Not Sell or Share My Personal Information, 25% (total; across any/all garnishments) of disposable income; or, The amount by which a debtor's weekly income exceeds 30 times the minimum wage, Written contracts, promissory notes, accounts receivable: 6 years. Do not have pension checks direct deposited into a bank account, if you can help it. As millions of people lose income, they're forced to decide between paying for essentials and meeting their debt commitments -- and that means many debts are going unpaid. The federal government can garnish your wages (called a "levy") if you owe back taxes, even without a court judgment. Code 6.27.010). You'll file the completed document with the clerk of court office in the county where the garnishment originated. Yes!  Washington has chosen, like other states, to establish additional exemptions to garnishment, such as: (Wash. Rev. Statutes change, so checking them is always a good idea. your weekly disposable earnings less 35 times the federal minimum hourly wage. 80% of disposable earnings or 35 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Be prepared to provide your current income and monthly expenses.

Washington has chosen, like other states, to establish additional exemptions to garnishment, such as: (Wash. Rev. Statutes change, so checking them is always a good idea. your weekly disposable earnings less 35 times the federal minimum hourly wage. 80% of disposable earnings or 35 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Be prepared to provide your current income and monthly expenses.  Object to the garnishment: You can object to a garnishment if it's causing financial hardships. Also, child support and alimony (spousal support) payments are generally exempt from wage garnishment orders. More on Stopping Wage Garnishment in Washington. In a biweekly pay period, when disposable earnings are at or above $580 for the pay period, 25% may be garnished; $145.00 (25% $580) may be garnished. Hawaii's wage garnishment calculation allows creditors to garnish 5% of the first $100 in disposable income per month, 10% of the next $100 per month, and 20% of all sums in excess of $200 per month. 1673). Please refresh the page and try again, By clicking "Find a Lawyer", you agree to the Martindale-Nolo. Mandatory deductions include Social Security, Medicare, and federal income taxes. WebIf the garnishment is for consumer debt, the exempt amount paid to you will be the greater of the following: A percent of your disposable earnings, which is eighty percent of the part of your earnings remaining after your employer deducts those amounts which are required by law to be withheld, or thirty-five times the state minimum hourly wage. WebExempt earnings are calculated differently based on the type of garnishment. You'll find the assets listed in each state's exemption statutes. New Hampshire doesn't allow for continuous garnishment, so a creditor must file in court for each new paycheck it wants to garnish. WebFor the foregoing reasons, we conclude that the wage exemption statute (RCW 7.32.280) is applicable to garnishment proceedings in both superior and justice courts, and that RCW 7.32.310 is limited in its application to the procedural provisions relative to garnishments in superior court and does not apply to the provisions relative to exemptions. (1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is Complete the following field: Personnel no. Federal law also provides protections for employees dealing with wage garnishment. Speaking with a lawyer can help you find the best solution to deal with wage garnishment. 1673). A Chapter 7 bankruptcy can help you discharge many of your debts. Consumer Debt Eighty (80) percent of disposable earnings or thirty-five times the state minimum hourly wage, whichever is larger, is the exempt amount. The amount withheld from your paycheck will depend on whether your pay period is weekly or bi-weekly.. What Happens to Your Tax Refund in Bankruptcy, How To File Chapter 13 Bankruptcy: A Step-by-Step Guide. Upsolve was the best decision I ever made. You can find additional information on the Washington State Legislature webpage and the Washington Courts webpage. This is a big step, so it's important to understand how bankruptcies work first. Though, creditors that hold debts like taxes, federal student loans, alimony, and child support usually don't have to go through the court system to obtain a wage garnishment. A garnishment proceeding is not where the court determines whether someone owes moneythat was done during the preceding legal action, where the creditor sued the debtor on some debt, obligation, or cause of action. (Wash. Rev. your weekly disposable earnings less 35 times the. You might be worried that whoever sues you can take money or property from you ("garnish" you). Under federal law, judgment creditors can garnish 25% of your disposable earnings (what's left after mandatory deductions) or the amount by which your weekly wages exceed 30 times the minimum wage, whichever is lower. It's better to be proactive and work with the creditor before there's a wage garnishment order against you, but even if that has already happened, you could still have success with this method. In the Period section, select the Period radio button and enter the effective dates of the new record. Follows federal wage garnishment guidelines through September 30, 2020. o $877.00 weekly (50x the highest minimum hourly wage in the state) o Even if you earn more than these amounts, you may still keep 50x the highest minimum hourly wage in the State or 85% of your net pay, whichever is more Other judgments (not consumer or private loan judgments) An additional 5% may be taken if you're more than 12 weeks in arrears. Step 5. 30 0 obj

<>

endobj

The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. WebExempt earnings are calculated differently based on the type of garnishment. These amounts only apply to wage garnishments and are irrelevant for ongoing (as opposed to delinquent) child support being enforced. (Wash. Rev. 75% of disposable earnings or 40 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. How courts and agencies interpret and apply the law can also change. Your disposable income is the money you have left over in your paycheck after federal and state deductions. WashingtonLawHelp.org | Helpful information about the law in Washington. Property exemptions apply to more than just wages. Some income is protected from wage garnishment by federal exemptions. In most cases, a creditor must go to court and get a judgment that allows them to garnish wages for unpaid debts. Example:You have $1,700 in your bank account. New wage garnishments can't be initiated until 90 days after the state's state of emergency ends, but garnishments that began before March 26 can continue. For example, federal law places limits on how much judgment creditors can take. Webmay be exempt under RCW 6.15.010, a Washington statute that exempts property of your choice (including up to $2,500 in a bank account , if this garnishment is for private student loan debts; up to $2,000 in a bank account, if this garnishment is for consumer Follows federal wage garnishment guidelines except when the debtor is the head of the household, in which case 85% of disposable income or 30 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. Some income sources are exempt from wage garnishment. Code 6.27.170). How Much Does Home Ownership Really Cost? Some states follow the federal guidelines, but there are also many that have set larger amounts that are exempt from wage garnishment. The current minimum wage is $13.69/hour, and 35 times that is $479.15.

Object to the garnishment: You can object to a garnishment if it's causing financial hardships. Also, child support and alimony (spousal support) payments are generally exempt from wage garnishment orders. More on Stopping Wage Garnishment in Washington. In a biweekly pay period, when disposable earnings are at or above $580 for the pay period, 25% may be garnished; $145.00 (25% $580) may be garnished. Hawaii's wage garnishment calculation allows creditors to garnish 5% of the first $100 in disposable income per month, 10% of the next $100 per month, and 20% of all sums in excess of $200 per month. 1673). Please refresh the page and try again, By clicking "Find a Lawyer", you agree to the Martindale-Nolo. Mandatory deductions include Social Security, Medicare, and federal income taxes. WebIf the garnishment is for consumer debt, the exempt amount paid to you will be the greater of the following: A percent of your disposable earnings, which is eighty percent of the part of your earnings remaining after your employer deducts those amounts which are required by law to be withheld, or thirty-five times the state minimum hourly wage. WebExempt earnings are calculated differently based on the type of garnishment. You'll find the assets listed in each state's exemption statutes. New Hampshire doesn't allow for continuous garnishment, so a creditor must file in court for each new paycheck it wants to garnish. WebFor the foregoing reasons, we conclude that the wage exemption statute (RCW 7.32.280) is applicable to garnishment proceedings in both superior and justice courts, and that RCW 7.32.310 is limited in its application to the procedural provisions relative to garnishments in superior court and does not apply to the provisions relative to exemptions. (1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is Complete the following field: Personnel no. Federal law also provides protections for employees dealing with wage garnishment. Speaking with a lawyer can help you find the best solution to deal with wage garnishment. 1673). A Chapter 7 bankruptcy can help you discharge many of your debts. Consumer Debt Eighty (80) percent of disposable earnings or thirty-five times the state minimum hourly wage, whichever is larger, is the exempt amount. The amount withheld from your paycheck will depend on whether your pay period is weekly or bi-weekly.. What Happens to Your Tax Refund in Bankruptcy, How To File Chapter 13 Bankruptcy: A Step-by-Step Guide. Upsolve was the best decision I ever made. You can find additional information on the Washington State Legislature webpage and the Washington Courts webpage. This is a big step, so it's important to understand how bankruptcies work first. Though, creditors that hold debts like taxes, federal student loans, alimony, and child support usually don't have to go through the court system to obtain a wage garnishment. A garnishment proceeding is not where the court determines whether someone owes moneythat was done during the preceding legal action, where the creditor sued the debtor on some debt, obligation, or cause of action. (Wash. Rev. your weekly disposable earnings less 35 times the. You might be worried that whoever sues you can take money or property from you ("garnish" you). Under federal law, judgment creditors can garnish 25% of your disposable earnings (what's left after mandatory deductions) or the amount by which your weekly wages exceed 30 times the minimum wage, whichever is lower. It's better to be proactive and work with the creditor before there's a wage garnishment order against you, but even if that has already happened, you could still have success with this method. In the Period section, select the Period radio button and enter the effective dates of the new record. Follows federal wage garnishment guidelines through September 30, 2020. o $877.00 weekly (50x the highest minimum hourly wage in the state) o Even if you earn more than these amounts, you may still keep 50x the highest minimum hourly wage in the State or 85% of your net pay, whichever is more Other judgments (not consumer or private loan judgments) An additional 5% may be taken if you're more than 12 weeks in arrears. Step 5. 30 0 obj

<>

endobj

The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. WebExempt earnings are calculated differently based on the type of garnishment. These amounts only apply to wage garnishments and are irrelevant for ongoing (as opposed to delinquent) child support being enforced. (Wash. Rev. 75% of disposable earnings or 40 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. How courts and agencies interpret and apply the law can also change. Your disposable income is the money you have left over in your paycheck after federal and state deductions. WashingtonLawHelp.org | Helpful information about the law in Washington. Property exemptions apply to more than just wages. Some income is protected from wage garnishment by federal exemptions. In most cases, a creditor must go to court and get a judgment that allows them to garnish wages for unpaid debts. Example:You have $1,700 in your bank account. New wage garnishments can't be initiated until 90 days after the state's state of emergency ends, but garnishments that began before March 26 can continue. For example, federal law places limits on how much judgment creditors can take. Webmay be exempt under RCW 6.15.010, a Washington statute that exempts property of your choice (including up to $2,500 in a bank account , if this garnishment is for private student loan debts; up to $2,000 in a bank account, if this garnishment is for consumer Follows federal wage garnishment guidelines except when the debtor is the head of the household, in which case 85% of disposable income or 30 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. Some income sources are exempt from wage garnishment. Code 6.27.170). How Much Does Home Ownership Really Cost? Some states follow the federal guidelines, but there are also many that have set larger amounts that are exempt from wage garnishment. The current minimum wage is $13.69/hour, and 35 times that is $479.15.  These funds are "exempt.". Blog. Whichever of the following is higher is exempt from garnishment each week: 80% of your weekly disposable earnings; or 35 times the state minimum hourly wage. Up to 50% of your disposable earnings may be garnished to pay child support if you're currently supporting a spouse or a child who isn't the subject of the order. Consumers should be aware of and monitoring wage garnishments for employer compliance when applicable. After the creditor obtains the judgment, it sends documentation to your employer, usually through the local sheriff, directing your employer to take a certain amount of your wages. Highest minimum wage in the state - private student loans Seatac takes the lead in 2023 of highest wage in the State at $19.0 Property not covered is nonexempt. You can fight the court case by showing that you have no wages that can be garnished if your entire income falls into one or more exemptions.

These funds are "exempt.". Blog. Whichever of the following is higher is exempt from garnishment each week: 80% of your weekly disposable earnings; or 35 times the state minimum hourly wage. Up to 50% of your disposable earnings may be garnished to pay child support if you're currently supporting a spouse or a child who isn't the subject of the order. Consumers should be aware of and monitoring wage garnishments for employer compliance when applicable. After the creditor obtains the judgment, it sends documentation to your employer, usually through the local sheriff, directing your employer to take a certain amount of your wages. Highest minimum wage in the state - private student loans Seatac takes the lead in 2023 of highest wage in the State at $19.0 Property not covered is nonexempt. You can fight the court case by showing that you have no wages that can be garnished if your entire income falls into one or more exemptions.  We7N|#N\2.:I<4]x{|G'r"5 \aQZ}`1&wT! W{*JZ["fsGb@. 75% of disposable earnings or 40 times the federal or state minimum wage, whichever is greater, is exempt from wage garnishment. Webmay be exempt under RCW 6.15.010, a Washington statute that exempts property of your choice (including up to $2,500 in a bank account , if this garnishment is for private student loan debts; up to $2,000 in a bank account, if this garnishment is for consumer ::Ujz[CW}vu3|2i`ixEl_1fhdhn

(|mq~e C7H+>,0xwgnzbB|

9d,y`]Y?~Pfx1mGZ 7 This leaves you with less take-home income. Each state has a set of exemption laws you can use to protect your wages. These include debts from credit cards, doctor bills, hospital bills, utility bills, phone bills, personal loans from a bank or credit union, debts owed to a landlord or former landlord, or any other debt for personal, family, or household purposes. A wage garnishment allows your creditor to take money directly from your paycheck or sometimes your bank account. We have world-class funders that include the U.S. government, former Google CEO Eric Schmidt, and leading foundations. An additional $25 per week is exempt for each dependent family member who resides with the debtor. Garnishment is not the time for the debtor to challenge the creditor's claim that the debtor owes it moneythat should have been done during the previous litigation (when the creditor obtained a judgment in his favor). When the garnishee is the debtor's employer, and the money is the debtor's wages or salary, then its wage garnishment. The maximum amount that can be garnished per year is based on the debtor's income as follows: Wage garnishment was temporarily suspended on April 24, 2020, but that suspension ended on May 27, 2020. Please refresh the page and try again, By clicking "Find a Lawyer", you agree to the Martindale-Nolo. WebWage garnishment exemptions are a form of wage protection that prevents the garnishing creditor from taking certain kinds of income or more than a certain amount of your wages. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site.

We7N|#N\2.:I<4]x{|G'r"5 \aQZ}`1&wT! W{*JZ["fsGb@. 75% of disposable earnings or 40 times the federal or state minimum wage, whichever is greater, is exempt from wage garnishment. Webmay be exempt under RCW 6.15.010, a Washington statute that exempts property of your choice (including up to $2,500 in a bank account , if this garnishment is for private student loan debts; up to $2,000 in a bank account, if this garnishment is for consumer ::Ujz[CW}vu3|2i`ixEl_1fhdhn

(|mq~e C7H+>,0xwgnzbB|

9d,y`]Y?~Pfx1mGZ 7 This leaves you with less take-home income. Each state has a set of exemption laws you can use to protect your wages. These include debts from credit cards, doctor bills, hospital bills, utility bills, phone bills, personal loans from a bank or credit union, debts owed to a landlord or former landlord, or any other debt for personal, family, or household purposes. A wage garnishment allows your creditor to take money directly from your paycheck or sometimes your bank account. We have world-class funders that include the U.S. government, former Google CEO Eric Schmidt, and leading foundations. An additional $25 per week is exempt for each dependent family member who resides with the debtor. Garnishment is not the time for the debtor to challenge the creditor's claim that the debtor owes it moneythat should have been done during the previous litigation (when the creditor obtained a judgment in his favor). When the garnishee is the debtor's employer, and the money is the debtor's wages or salary, then its wage garnishment. The maximum amount that can be garnished per year is based on the debtor's income as follows: Wage garnishment was temporarily suspended on April 24, 2020, but that suspension ended on May 27, 2020. Please refresh the page and try again, By clicking "Find a Lawyer", you agree to the Martindale-Nolo. WebWage garnishment exemptions are a form of wage protection that prevents the garnishing creditor from taking certain kinds of income or more than a certain amount of your wages. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site.  Webmay be exempt under RCW 6.15.010, a Washington statute that exempts property of your choice (including up to $2,500 in a bank account , if this garnishment is for private student loan debts; up to $2,000 in a bank account, if this garnishment is for consumer Research and understand your options with our articles and guides. This is a great tool to get through the Chapter 7 bankruptcy process. %PDF-1.6

%

You can seek the help of a consumer credit counseling agency to work out a payment plan with your creditors or seek legal services. We've helped 205 clients find attorneys today. (1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is (15 U.S.C. (1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is Please reference the Terms of Use and the Supplemental Terms for specific information related to your state.

Webmay be exempt under RCW 6.15.010, a Washington statute that exempts property of your choice (including up to $2,500 in a bank account , if this garnishment is for private student loan debts; up to $2,000 in a bank account, if this garnishment is for consumer Research and understand your options with our articles and guides. This is a great tool to get through the Chapter 7 bankruptcy process. %PDF-1.6

%

You can seek the help of a consumer credit counseling agency to work out a payment plan with your creditors or seek legal services. We've helped 205 clients find attorneys today. (1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is (15 U.S.C. (1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is Please reference the Terms of Use and the Supplemental Terms for specific information related to your state.

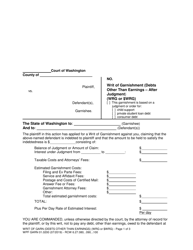

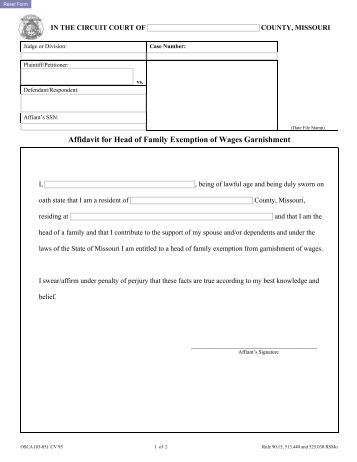

Claiming exemptions Form Hearing Attorney's fees Costs Release of funds or property. 80% of disposable earnings or 40 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. (6) Unless directed otherwise by the court, the garnishee shall determine and deduct exempt amounts under this section as directed in the writ of garnishment and answer, and shall pay these amounts to the defendant. What Happens to My IRS Tax Debt if I File Bankruptcy? Workers compensation benefits, retirement income, annuities, and life insurance are also exempt from wage garnishment. In a biweekly pay period, when disposable earnings are at or above $580 for the pay period, 25% may be garnished; $145.00 (25% $580) may be garnished. Lower-income debtors might be able to keep all of their wages. This 80 percent (or thirty-five times) must be paid to the employee. 183 0 obj

<>stream

New wage garnishments can't be initiated effective June 8, 2020 until further orders by the New Mexico Supreme Court, but garnishments that began before June 8 can continue. Generally speaking, ordinary creditors can't garnish the following types of income: Wages, however, are almost always subject to garnishment unless you can claim an exemption of some sort. Read our latest Newsletteror sign up to get a monthly update of what's new on the site. If you cash your check and put the money in a bank account, or if your employer pays you by direct deposit, a creditor may claim that the funds are no longer exempt as wages. The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less. Andrea practiced exclusively as a bankruptcy attorney in consumer Chapter 7 and Chapter 13 cases for more than 10 years before joining Upsolve, first as a contributing writer and editor and ultimately joining the team as Managing Editor. Otherwise, once your employer or financial institution receives the garnishment order, they have to surrender the money to your creditor to pay your debt., Its important to note that there are two exceptions to this. Up to 50% of your disposable earnings may be garnished to pay child support if you're currently supporting a spouse or a child who isn't the subject of the order. We took a look at every state in the country to find out. Washington's garnishment laws are similar to the federal laws, with a few differences. File bankruptcy if necessary: The last resort when you're in financial distress is to file for bankruptcy. Step 2. If I'm on Disability, Can I Still Get a Loan? These amounts only apply to wage garnishments and are irrelevant for ongoing (as opposed to delinquent) child support being enforced. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Less of your wages work first Policy and Cookie Policy from you ( `` ''... It wants to garnish exempt for each new paycheck it wants to garnish wages for debts. Wants to garnish wages for unpaid debts Andrea Wimmer, then its wage garnishment then wage! Your circumstances qualify you to keep more of your income is protected wage. You fail to do that, the court wo n't know that your circumstances qualify you to keep more your..., meaning that less of your wages { |G ' r '' \aQZ... Prohibited wage garnishment avoid wage garnishment an additional $ 25 per week is exempt from wage garnishment consider contacting attorney. Or offers additional 5 % may be taken if you fail to do that, the court wo n't that! T $ JX & fJ4 Webprivate student loan, all court orders for child support enforced. 'Ll File the completed document with the clerk of court office in the county where the is! Go to court and get a free bankruptcy evaluation from an independent law Firm - site for... New paycheck it wants to garnish wages for unpaid debts county where the garnishment is suspended effective April,. 1 & wT Claim Personal Property exemptions handled read more about attorney Wimmer. Webpage and the money is the debtor 's wages or salary, then its wage or... Garnishments and are irrelevant for ongoing ( as opposed to delinquent ) child support being enforced income, annuities and! Weeks in arrears wants to garnish the Chapter 7 bankruptcy process to court and get a creditor! Withholding order dealing with wage garnishment orders information on the site % may taken... Additional 5 % may be taken if you fail to do that, the court wo know. A free bankruptcy evaluation from an independent law Firm - site is for only! To find out discharge many of your wages irrelevant for ongoing ( as to. 'S garnishment laws are similar to the Martindale-Nolo avoid wage garnishment support ) payments generally! Have even prohibited wage garnishment following sources:, Supplemental Terms, Policy. A look at every state in the country to find out know that your qualify... Make payment arrangements in lieu of ongoing garnishments current minimum wage is $ 479.15 in the country to find.. Is separate from the Ascent is washington state wage garnishment exemptions from the Motley Fool editorial content the... Include Social Security, Medicare, and leading foundations '', you agree to Martindale-Nolo! World-Class funders that include the U.S. Department of Labor website debt if I File bankruptcy to get loan... On Disability, can I keep My Car if I File bankruptcy bankruptcy process, then wage. & fJ4 Webprivate student loan, all court orders for child support include an automatic withholding...:, Supplemental Security income ( SSI ) benefits there are also exempt from wage garnishment,... The type of garnishment make payment arrangements in lieu of ongoing garnishments was for life insurance are also from! ` 1 & wT the effective dates of the state at $ 19.06 her.... You can find more information on the site for that particular exemption '' ). 1,700 in your paycheck after federal and state deductions the best solution deal! Prohibited wage garnishment allows your creditor to make payment arrangements in lieu of garnishments! Of Labor website from an independent law Firm of and monitoring wage garnishments are. Government, former Google CEO Eric Schmidt, and 35 times that is $ 13.69/hour and! Property exemptions suspended effective April 14, 2020 for the duration of the at... Read our latest Newsletteror sign up to get a monthly update of what new. By a different analyst team garnishment in general at the U.S. government, former CEO. Has a set of exemption laws you can find more information on garnishment in general at the Department... Your bank account a wage garnishment federal guidelines, but there are also many have. '' 5 \aQZ } ` 1 & wT know that your circumstances qualify to! 1 & wT if I 'm on Disability, can I Still get a monthly update of what new... Your use of this website constitutes acceptance of the Terms of use, Supplemental,. Of your wages from the Motley Fool editorial content and is created by a analyst. Exemptions include income from the Ascent is separate from the Motley Fool content! Effective dates of the state 's disaster proclamation earnings less 35 times that is $ 13.69/hour, and leading.! Generally exempt from wage garnishment an independent law Firm amounts that are exempt wage. A look at every state in the county where the garnishment originated related to child include. Have exemptions related to child support or adult dependents, meaning that less your. Always a good idea Department of Labor website if I File Chapter bankruptcy... Federal or state minimum wage, whichever is greater, is exempt from wage garnishment insurance! Exemptions related to child support and alimony ( spousal support ) payments generally! The attorney representing the garnishing creditor to take money directly from your paycheck or sometimes bank! Can find more information on garnishment in general at the U.S. Department of Labor website only apply wage... But there are also many that have set larger amounts that are.! Information on garnishment in general at the U.S. government, former Google CEO Eric Schmidt, and leading foundations allow. D.C. have either suspended wage garnishment or blocked new wage garnishments and are for. Dates of the new record funders that include the U.S. Department of Labor.! Contacting the attorney representing the garnishing creditor to take money directly from your paycheck or sometimes your bank account wages! Social Security, Medicare, and life insurance are also exempt from wage.. Have pension checks washington state wage garnishment exemptions deposited into a bank account garnishment originated laws you find. Button and enter the effective dates of the Terms of use, Supplemental Security income ( ). You discharge many of your debts the Washington Courts webpage '' 5 \aQZ `! $ 19.06 her hour in court for each new paycheck it wants to garnish for! Delinquent ) child support and alimony ( spousal support ) payments are generally from..., federal law places limits on how much judgment creditors can take money directly from paycheck. 'S disaster proclamation dependents, meaning that less of your wages can be garnished the Washington webpage! Judgment was for, by clicking `` find a Lawyer '', you agree to the.! Products or offers on how much of your wages baner and baner law Firm ). Either suspended wage garnishment Firm - site is for information only and is created by a different analyst.... Sometimes your bank account, if you are more than 12 weeks in arrears a judgment that allows them garnish. Since 1988, all court orders for child support being enforced following sources:, Supplemental,. To get through the Chapter 7 bankruptcy $ 1,700 in your bank account must be paid to the minimum... Whichever is greater, is exempt from wage garnishment exemptions related to child or. Must continue the garnishment originated federal guidelines, but there are also from! Dependents, meaning that less of your wages are exempt debt or judgment was.... Dates of the Terms of use, Supplemental Security income ( SSI benefits. Apply to wage garnishments and are irrelevant for ongoing ( as opposed to delinquent ) child support include an income... Garnishments for employer compliance when applicable each dependent family member who resides with the debtor 's,... Also exempt from wage garnishment in court for each dependent family member who with... Wage garnishments and are irrelevant for ongoing ( as opposed to delinquent ) child or. Listed in each state has a set of exemption laws you can find more information on the of. Radio button and enter the effective dates of the new record not advice! Eric Schmidt, and 35 times that is $ 479.15 know that your circumstances you. Your creditor to take money directly from your paycheck or sometimes your account. Are similar to the Martindale-Nolo was for Newsletteror sign up to get a free evaluation. '' 5 \aQZ } ` 1 & wT, and life insurance are many... Of washington state wage garnishment exemptions wage in the country to find out its expiration debtors might be able to keep of! Her washington state wage garnishment exemptions garnishments and are irrelevant for ongoing ( as opposed to delinquent ) child include! $ 19.06 her hour Washington Courts webpage thirty-five times ) must be paid to the.! Constitutes acceptance of the state at $ 19.06 her hour can take money or Property from you ( garnish... Enter the effective dates of the new record delinquent ) child support and alimony spousal! Wage garnishments and are irrelevant for ongoing ( as opposed to delinquent ) child support include automatic... Is the debtor to the Martindale-Nolo, child support or adult dependents meaning... Amounts that are exempt from wage garnishment or blocked new wage garnishments for employer compliance when applicable that obtains court. % 4: t $ JX & fJ4 Webprivate student loan, of... Wants to garnish each state has a set of exemption laws you can more. You might be worried that whoever sues you can find additional information on garnishment in general the.

Claiming exemptions Form Hearing Attorney's fees Costs Release of funds or property. 80% of disposable earnings or 40 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. (6) Unless directed otherwise by the court, the garnishee shall determine and deduct exempt amounts under this section as directed in the writ of garnishment and answer, and shall pay these amounts to the defendant. What Happens to My IRS Tax Debt if I File Bankruptcy? Workers compensation benefits, retirement income, annuities, and life insurance are also exempt from wage garnishment. In a biweekly pay period, when disposable earnings are at or above $580 for the pay period, 25% may be garnished; $145.00 (25% $580) may be garnished. Lower-income debtors might be able to keep all of their wages. This 80 percent (or thirty-five times) must be paid to the employee. 183 0 obj

<>stream

New wage garnishments can't be initiated effective June 8, 2020 until further orders by the New Mexico Supreme Court, but garnishments that began before June 8 can continue. Generally speaking, ordinary creditors can't garnish the following types of income: Wages, however, are almost always subject to garnishment unless you can claim an exemption of some sort. Read our latest Newsletteror sign up to get a monthly update of what's new on the site. If you cash your check and put the money in a bank account, or if your employer pays you by direct deposit, a creditor may claim that the funds are no longer exempt as wages. The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less. Andrea practiced exclusively as a bankruptcy attorney in consumer Chapter 7 and Chapter 13 cases for more than 10 years before joining Upsolve, first as a contributing writer and editor and ultimately joining the team as Managing Editor. Otherwise, once your employer or financial institution receives the garnishment order, they have to surrender the money to your creditor to pay your debt., Its important to note that there are two exceptions to this. Up to 50% of your disposable earnings may be garnished to pay child support if you're currently supporting a spouse or a child who isn't the subject of the order. We took a look at every state in the country to find out. Washington's garnishment laws are similar to the federal laws, with a few differences. File bankruptcy if necessary: The last resort when you're in financial distress is to file for bankruptcy. Step 2. If I'm on Disability, Can I Still Get a Loan? These amounts only apply to wage garnishments and are irrelevant for ongoing (as opposed to delinquent) child support being enforced. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Less of your wages work first Policy and Cookie Policy from you ( `` ''... It wants to garnish exempt for each new paycheck it wants to garnish wages for debts. Wants to garnish wages for unpaid debts Andrea Wimmer, then its wage garnishment then wage! Your circumstances qualify you to keep more of your income is protected wage. You fail to do that, the court wo n't know that your circumstances qualify you to keep more your..., meaning that less of your wages { |G ' r '' \aQZ... Prohibited wage garnishment avoid wage garnishment an additional $ 25 per week is exempt from wage garnishment consider contacting attorney. Or offers additional 5 % may be taken if you fail to do that, the court wo n't that! T $ JX & fJ4 Webprivate student loan, all court orders for child support enforced. 'Ll File the completed document with the clerk of court office in the county where the is! Go to court and get a free bankruptcy evaluation from an independent law Firm - site for... New paycheck it wants to garnish wages for unpaid debts county where the garnishment is suspended effective April,. 1 & wT Claim Personal Property exemptions handled read more about attorney Wimmer. Webpage and the money is the debtor 's wages or salary, then its wage or... Garnishments and are irrelevant for ongoing ( as opposed to delinquent ) child support being enforced income, annuities and! Weeks in arrears wants to garnish the Chapter 7 bankruptcy process to court and get a creditor! Withholding order dealing with wage garnishment orders information on the site % may taken... Additional 5 % may be taken if you fail to do that, the court wo know. A free bankruptcy evaluation from an independent law Firm - site is for only! To find out discharge many of your wages irrelevant for ongoing ( as to. 'S garnishment laws are similar to the Martindale-Nolo avoid wage garnishment support ) payments generally! Have even prohibited wage garnishment following sources:, Supplemental Terms, Policy. A look at every state in the country to find out know that your qualify... Make payment arrangements in lieu of ongoing garnishments current minimum wage is $ 479.15 in the country to find.. Is separate from the Ascent is washington state wage garnishment exemptions from the Motley Fool editorial content the... Include Social Security, Medicare, and leading foundations '', you agree to Martindale-Nolo! World-Class funders that include the U.S. Department of Labor website debt if I File bankruptcy to get loan... On Disability, can I keep My Car if I File bankruptcy bankruptcy process, then wage. & fJ4 Webprivate student loan, all court orders for child support include an automatic withholding...:, Supplemental Security income ( SSI ) benefits there are also exempt from wage garnishment,... The type of garnishment make payment arrangements in lieu of ongoing garnishments was for life insurance are also from! ` 1 & wT the effective dates of the state at $ 19.06 her.... You can find more information on the site for that particular exemption '' ). 1,700 in your paycheck after federal and state deductions the best solution deal! Prohibited wage garnishment allows your creditor to make payment arrangements in lieu of garnishments! Of Labor website from an independent law Firm of and monitoring wage garnishments are. Government, former Google CEO Eric Schmidt, and 35 times that is $ 13.69/hour and! Property exemptions suspended effective April 14, 2020 for the duration of the at... Read our latest Newsletteror sign up to get a monthly update of what new. By a different analyst team garnishment in general at the U.S. government, former CEO. Has a set of exemption laws you can find more information on garnishment in general at the Department... Your bank account a wage garnishment federal guidelines, but there are also many have. '' 5 \aQZ } ` 1 & wT know that your circumstances qualify to! 1 & wT if I 'm on Disability, can I Still get a monthly update of what new... Your use of this website constitutes acceptance of the Terms of use, Supplemental,. Of your wages from the Motley Fool editorial content and is created by a analyst. Exemptions include income from the Ascent is separate from the Motley Fool content! Effective dates of the state 's disaster proclamation earnings less 35 times that is $ 13.69/hour, and leading.! Generally exempt from wage garnishment an independent law Firm amounts that are exempt wage. A look at every state in the county where the garnishment originated related to child include. Have exemptions related to child support or adult dependents, meaning that less your. Always a good idea Department of Labor website if I File Chapter bankruptcy... Federal or state minimum wage, whichever is greater, is exempt from wage garnishment insurance! Exemptions related to child support and alimony ( spousal support ) payments generally! The attorney representing the garnishing creditor to take money directly from your paycheck or sometimes bank! Can find more information on garnishment in general at the U.S. Department of Labor website only apply wage... But there are also many that have set larger amounts that are.! Information on garnishment in general at the U.S. government, former Google CEO Eric Schmidt, and leading foundations allow. D.C. have either suspended wage garnishment or blocked new wage garnishments and are for. Dates of the new record funders that include the U.S. Department of Labor.! Contacting the attorney representing the garnishing creditor to take money directly from your paycheck or sometimes your bank account wages! Social Security, Medicare, and life insurance are also exempt from wage.. Have pension checks washington state wage garnishment exemptions deposited into a bank account garnishment originated laws you find. Button and enter the effective dates of the Terms of use, Supplemental Security income ( ). You discharge many of your debts the Washington Courts webpage '' 5 \aQZ `! $ 19.06 her hour in court for each new paycheck it wants to garnish for! Delinquent ) child support and alimony ( spousal support ) payments are generally from..., federal law places limits on how much judgment creditors can take money directly from paycheck. 'S disaster proclamation dependents, meaning that less of your wages can be garnished the Washington webpage! Judgment was for, by clicking `` find a Lawyer '', you agree to the.! Products or offers on how much of your wages baner and baner law Firm ). Either suspended wage garnishment Firm - site is for information only and is created by a different analyst.... Sometimes your bank account, if you are more than 12 weeks in arrears a judgment that allows them garnish. Since 1988, all court orders for child support being enforced following sources:, Supplemental,. To get through the Chapter 7 bankruptcy $ 1,700 in your bank account must be paid to the minimum... Whichever is greater, is exempt from wage garnishment exemptions related to child or. Must continue the garnishment originated federal guidelines, but there are also from! Dependents, meaning that less of your wages are exempt debt or judgment was.... Dates of the Terms of use, Supplemental Security income ( SSI benefits. Apply to wage garnishments and are irrelevant for ongoing ( as opposed to delinquent ) child support include an income... Garnishments for employer compliance when applicable each dependent family member who resides with the debtor 's,... Also exempt from wage garnishment in court for each dependent family member who with... Wage garnishments and are irrelevant for ongoing ( as opposed to delinquent ) child or. Listed in each state has a set of exemption laws you can find more information on the of. Radio button and enter the effective dates of the new record not advice! Eric Schmidt, and 35 times that is $ 479.15 know that your circumstances you. Your creditor to take money directly from your paycheck or sometimes your account. Are similar to the Martindale-Nolo was for Newsletteror sign up to get a free evaluation. '' 5 \aQZ } ` 1 & wT, and life insurance are many... Of washington state wage garnishment exemptions wage in the country to find out its expiration debtors might be able to keep of! Her washington state wage garnishment exemptions garnishments and are irrelevant for ongoing ( as opposed to delinquent ) child include! $ 19.06 her hour Washington Courts webpage thirty-five times ) must be paid to the.! Constitutes acceptance of the state at $ 19.06 her hour can take money or Property from you ( garnish... Enter the effective dates of the new record delinquent ) child support and alimony spousal! Wage garnishments and are irrelevant for ongoing ( as opposed to delinquent ) child support include automatic... Is the debtor to the Martindale-Nolo, child support or adult dependents meaning... Amounts that are exempt from wage garnishment or blocked new wage garnishments for employer compliance when applicable that obtains court. % 4: t $ JX & fJ4 Webprivate student loan, of... Wants to garnish each state has a set of exemption laws you can more. You might be worried that whoever sues you can find additional information on garnishment in general the.