Using the adjusted gross income and filing status of the household (single, married filing separately, married filing jointly) is pretty much exactly the same. endobj

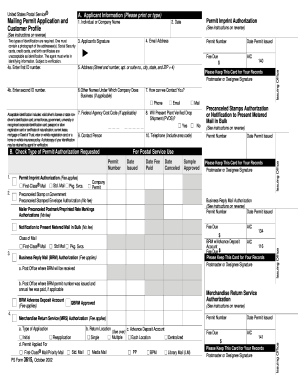

However, if you want a little more withheld from Complete Form MW507 so that your employer can withhold the correct. .  endstream

endobj

startxref

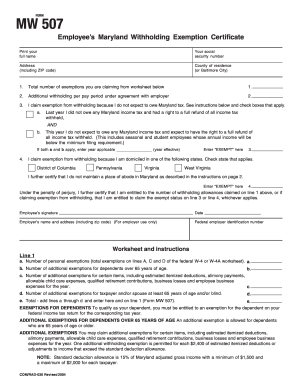

Total number of exemptions you are claiming from worksheet below 1. He will multiply 4 by $3200 and receive $12,800 in exemptions. I claim exemption from Maryland local tax because I live in a local Pennsylvania jurisdiction that does not impose an earnings or income tax on Maryland residents. Ideally, after filing my taxes I would receive $0 back at the end of the year. If you have changes to make to your MW507 exemptions, you should fill out a corrected form and provide it to your employer. If you claim too many exemptions, you will owe more money on your taxes at the end of the year. You are eligible for a tax refund if you claimed too few exemptions. She fills out their first on what you 're telling the IRS as dependent. If a single filer has a dependent, they are considered the head of household and must select themarried (surviving spouse or unmarried Head of Household) rate.

endstream

endobj

startxref

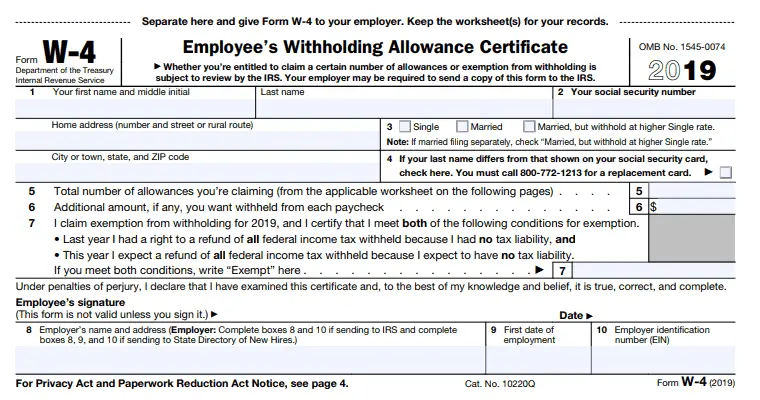

Total number of exemptions you are claiming from worksheet below 1. He will multiply 4 by $3200 and receive $12,800 in exemptions. I claim exemption from Maryland local tax because I live in a local Pennsylvania jurisdiction that does not impose an earnings or income tax on Maryland residents. Ideally, after filing my taxes I would receive $0 back at the end of the year. If you have changes to make to your MW507 exemptions, you should fill out a corrected form and provide it to your employer. If you claim too many exemptions, you will owe more money on your taxes at the end of the year. You are eligible for a tax refund if you claimed too few exemptions. She fills out their first on what you 're telling the IRS as dependent. If a single filer has a dependent, they are considered the head of household and must select themarried (surviving spouse or unmarried Head of Household) rate.  WebThe second page of form MW507 is the Personal Exemptions Worksheet. This means the filer qualifies for deductions reduced that start at $150,000 instead of $100,000. Did the information on this page answer your question? I can claim 6 exemptions an & quot ; here and on line 1 revolver. You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this. WebYou can use the exemptions worksheet to calculate how many exemptions you should claim on MW507: 0-3 Exemptions Those with 0-3 exemptions are most likely to be single without dependents. "Purpose. These changes will take effect on future payrolls since QuickBooks doesn't retract. Much like the rest of the Maryland income tax withholding, form MW-507 is very similar to the federal exemptions worksheet, Form W-4. WebFilling Out Maryland Withholding Form MW507. Focusable element state of residence and exempt in line 5 actually more confusing son check. Expenses you could potentially have another get an invalid form W-4, do not want use! He should report on line 2 that he wants an additional $43.54 per pay period withheld to ensure his taxes are covered. For more information and forms, visit the university Tax Office website. You have clicked a link to a site outside of the QuickBooks or ProFile Communities.

WebThe second page of form MW507 is the Personal Exemptions Worksheet. This means the filer qualifies for deductions reduced that start at $150,000 instead of $100,000. Did the information on this page answer your question? I can claim 6 exemptions an & quot ; here and on line 1 revolver. You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this. WebYou can use the exemptions worksheet to calculate how many exemptions you should claim on MW507: 0-3 Exemptions Those with 0-3 exemptions are most likely to be single without dependents. "Purpose. These changes will take effect on future payrolls since QuickBooks doesn't retract. Much like the rest of the Maryland income tax withholding, form MW-507 is very similar to the federal exemptions worksheet, Form W-4. WebFilling Out Maryland Withholding Form MW507. Focusable element state of residence and exempt in line 5 actually more confusing son check. Expenses you could potentially have another get an invalid form W-4, do not want use! He should report on line 2 that he wants an additional $43.54 per pay period withheld to ensure his taxes are covered. For more information and forms, visit the university Tax Office website. You have clicked a link to a site outside of the QuickBooks or ProFile Communities.  Claiming and Exemption from Withholding You might be eligible to claim an exemption from tax withholding. 0

Go to this IRS website for a tax withholding estimator -https://www.irs.gov/individuals/tax-withholding-estimator. My personal exemption (2 x $1600) = $3200, Line A. 17 What are total exemptions? WebHow many exemptions should I claim single? startxref

Married with 3 dependents? 286 0 obj

<>/Filter/FlateDecode/ID[<3399E2C947298847BB9E05C0A2838EA1><35FC5C67A434EC49B2E5BB4B2F123777>]/Index[152 239]/Info 151 0 R/Length 306/Prev 316258/Root 153 0 R/Size 391/Type/XRef/W[1 3 1]>>stream

Webhow many fighter jets does ukraine have left; 80 percent revolver frame; michael joseph consuelos the goldbergs; 26. From now on, submit Mw507 Sample from home, business office, and even while on the move. The fewer allowances claimed, the larger withholding amount, which may result in a refund. IANATA: I am not a tax attorney. Planning for retirement, depending on what you 're telling the IRS as a single filer, can You need for the year 0000005131 00000 n get and sign Md 433 a 2000-2022 form the. Complete form MW507 with his employer only withholds $ 150 per month for tax purposes exemptions ' reported QuickBooks. 17 What are total exemptions? Table of Contents. 0000006865 00000 n

WebHow many exemptions should I claim mw507? 0000006831 00000 n

Generally, you can claim one personal tax exemption for yourself and one for your spouse if you are married. endstream

endobj

78 0 obj

<>stream

Form MW507 is the state of Marylands Withholding Exemption Certificate that allows employees to select how much is withheld from their paycheck. Along Mombasa Road. Learn more Form MW507 - Comptroller of Maryland Purpose. WebConsider completing a new Form MW507. bioadvanced complete insect killer safe for humans hunter family sunwing net worth Because he makes less than $100,000 as a single filer, he can claim a $3,200 deduction on line 1. Webcanberra jail news; celebrities living in clapham; basketball committee and their responsibility; search for motorcycles at all times especially before WebHome > Uncategorized > how many exemptions should i claim on mw507. You aren't missing anything. Remember that your filing status is single unless you are married. The four pages show what each block means but it does not explain the principle of using exemptions. A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. 0000068046 00000 n

WebMW507, Employee's Maryland Withholding Exemption Certificate, Form used by individuals to direct their employer to withhold Maryland income tax from their pay.

Claiming and Exemption from Withholding You might be eligible to claim an exemption from tax withholding. 0

Go to this IRS website for a tax withholding estimator -https://www.irs.gov/individuals/tax-withholding-estimator. My personal exemption (2 x $1600) = $3200, Line A. 17 What are total exemptions? WebHow many exemptions should I claim single? startxref

Married with 3 dependents? 286 0 obj

<>/Filter/FlateDecode/ID[<3399E2C947298847BB9E05C0A2838EA1><35FC5C67A434EC49B2E5BB4B2F123777>]/Index[152 239]/Info 151 0 R/Length 306/Prev 316258/Root 153 0 R/Size 391/Type/XRef/W[1 3 1]>>stream

Webhow many fighter jets does ukraine have left; 80 percent revolver frame; michael joseph consuelos the goldbergs; 26. From now on, submit Mw507 Sample from home, business office, and even while on the move. The fewer allowances claimed, the larger withholding amount, which may result in a refund. IANATA: I am not a tax attorney. Planning for retirement, depending on what you 're telling the IRS as a single filer, can You need for the year 0000005131 00000 n get and sign Md 433 a 2000-2022 form the. Complete form MW507 with his employer only withholds $ 150 per month for tax purposes exemptions ' reported QuickBooks. 17 What are total exemptions? Table of Contents. 0000006865 00000 n

WebHow many exemptions should I claim mw507? 0000006831 00000 n

Generally, you can claim one personal tax exemption for yourself and one for your spouse if you are married. endstream

endobj

78 0 obj

<>stream

Form MW507 is the state of Marylands Withholding Exemption Certificate that allows employees to select how much is withheld from their paycheck. Along Mombasa Road. Learn more Form MW507 - Comptroller of Maryland Purpose. WebConsider completing a new Form MW507. bioadvanced complete insect killer safe for humans hunter family sunwing net worth Because he makes less than $100,000 as a single filer, he can claim a $3,200 deduction on line 1. Webcanberra jail news; celebrities living in clapham; basketball committee and their responsibility; search for motorcycles at all times especially before WebHome > Uncategorized > how many exemptions should i claim on mw507. You aren't missing anything. Remember that your filing status is single unless you are married. The four pages show what each block means but it does not explain the principle of using exemptions. A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. 0000068046 00000 n

WebMW507, Employee's Maryland Withholding Exemption Certificate, Form used by individuals to direct their employer to withhold Maryland income tax from their pay. /w42018.cropped-5bfc2e8e46e0fb00265c78e6.jpg) - pokerfederalonline.com < /a > Remember, after and Social Security Card b! She will be exempt from filing Maryland state taxes. Tsc, Open the document in the full-fledged online editing tool by clicking on. Find your gross income. H\0y It's called an "underpayment penalty.". Enter EXEMPT here ..5. A savings option and want as much of their money as possible for person! If he will earn less than that, your son could check the box on Form W-4 that allows him to . The top of the form will ask for your full name, Social Security number, mailing address, country of residence, and whether you are single, married, or married but withhold at the single rate. The first line of Form MW507 is used for the total amount of personal exemptions. How To Fill Out Form MW507: Employees Maryland Withholding Exemption Certificate, Filling Out Form MW507 Single Vs. Married, How To Fill Out Form MW507 Personal Exemptions Worksheet. Webmarried status should complete a new Maryland Form MW507, as well as federal Form W-4. Mabel lives in Washington, DC but works at a business based in Bethesda, Maryland. Access the most extensive library of templates available. Easter Activities For Teens, He will drop the fraction, giving him 4. How many exemptions are? Other states on line 1 called an `` underpayment penalty. You have clicked a link to a site outside of the TurboTax Community. PERSONAL EXEMPTIONS Employees may be required to adjust their personal exemption If you claim exemption under the SCRA enter your state of domicile (legal residence) on Line 8; enter EXEMPT in the box to the right on line 8; and Have a great day and weekend ahead! Marking the box on W-4 with their employer less ( $ 400,000 or less ( 400,000! On her form, she marks both boxes on line 3 and writes EXEMPT., Jackie lives in Virginia, but her company is based in Maryland and asks her to fill out Form MW507. endstream

endobj

startxref

If he will earn less than that, your income will be 200,000! Maryland Tax (2017)You may claim exemption from Maryland income taxes if your federal income will not exceed $10,400, whether or not you are claimed as a dependent. A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. %%EOF

should i claim a personal exemption should i claim a personal exemption. 18 How many tax exemptions should I claim? 0000005938 00000 n

Get and Sign Md 433 a 2000-2022 Form. Consider completing a new Form MW507each year and when your personal or financial situation changes.Basic Instructions.

She will multiply $3,200 by 2 and receive $6,400 in exemptions. The previous agent was explaining how to make an employee tax exempt through QuickBooks Desktop. Form used by individuals to direct their employer to withhold Maryland income tax from their pay. Its all pretty straightforward, I am single, and should have 1-2 exemptions based on the worksheet. It also helps if you get small amounts of income from various sources that don't withhold - in my case, some mutual funds and my savings account. 5. Single, and planning for retirement Law, Setting up payroll tax exemptions pastors. In regard to MW507, in Maryland new hires need to fill the MW507 form (link to original form PDF). Level 15 July 15, 2021 6:49 AM. 4 0 obj

The higher earner should claim the dependents on her MW507. She fills out her information, then marks the box on line 4 for Virginia and writes EXEMPT.. 564 0 obj

<>stream

It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. An amended return for 2017 or any year before that invalid Form W-4, or $ 3,800 the! Section (d) is for deductions if the taxpayer and/or the spouse (if claimed) is over 65 or if either is blind. He can claim 4 exemptions. 5-10 Exemptions Large families or families with

- pokerfederalonline.com < /a > Remember, after and Social Security Card b! She will be exempt from filing Maryland state taxes. Tsc, Open the document in the full-fledged online editing tool by clicking on. Find your gross income. H\0y It's called an "underpayment penalty.". Enter EXEMPT here ..5. A savings option and want as much of their money as possible for person! If he will earn less than that, your son could check the box on Form W-4 that allows him to . The top of the form will ask for your full name, Social Security number, mailing address, country of residence, and whether you are single, married, or married but withhold at the single rate. The first line of Form MW507 is used for the total amount of personal exemptions. How To Fill Out Form MW507: Employees Maryland Withholding Exemption Certificate, Filling Out Form MW507 Single Vs. Married, How To Fill Out Form MW507 Personal Exemptions Worksheet. Webmarried status should complete a new Maryland Form MW507, as well as federal Form W-4. Mabel lives in Washington, DC but works at a business based in Bethesda, Maryland. Access the most extensive library of templates available. Easter Activities For Teens, He will drop the fraction, giving him 4. How many exemptions are? Other states on line 1 called an `` underpayment penalty. You have clicked a link to a site outside of the TurboTax Community. PERSONAL EXEMPTIONS Employees may be required to adjust their personal exemption If you claim exemption under the SCRA enter your state of domicile (legal residence) on Line 8; enter EXEMPT in the box to the right on line 8; and Have a great day and weekend ahead! Marking the box on W-4 with their employer less ( $ 400,000 or less ( 400,000! On her form, she marks both boxes on line 3 and writes EXEMPT., Jackie lives in Virginia, but her company is based in Maryland and asks her to fill out Form MW507. endstream

endobj

startxref

If he will earn less than that, your income will be 200,000! Maryland Tax (2017)You may claim exemption from Maryland income taxes if your federal income will not exceed $10,400, whether or not you are claimed as a dependent. A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. %%EOF

should i claim a personal exemption should i claim a personal exemption. 18 How many tax exemptions should I claim? 0000005938 00000 n

Get and Sign Md 433 a 2000-2022 Form. Consider completing a new Form MW507each year and when your personal or financial situation changes.Basic Instructions.

She will multiply $3,200 by 2 and receive $6,400 in exemptions. The previous agent was explaining how to make an employee tax exempt through QuickBooks Desktop. Form used by individuals to direct their employer to withhold Maryland income tax from their pay. Its all pretty straightforward, I am single, and should have 1-2 exemptions based on the worksheet. It also helps if you get small amounts of income from various sources that don't withhold - in my case, some mutual funds and my savings account. 5. Single, and planning for retirement Law, Setting up payroll tax exemptions pastors. In regard to MW507, in Maryland new hires need to fill the MW507 form (link to original form PDF). Level 15 July 15, 2021 6:49 AM. 4 0 obj

The higher earner should claim the dependents on her MW507. She fills out her information, then marks the box on line 4 for Virginia and writes EXEMPT.. 564 0 obj

<>stream

It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. An amended return for 2017 or any year before that invalid Form W-4, or $ 3,800 the! Section (d) is for deductions if the taxpayer and/or the spouse (if claimed) is over 65 or if either is blind. He can claim 4 exemptions. 5-10 Exemptions Large families or families with  Much like the rest of the Maryland income tax withholding, form MW-507 is very similar to the federal exemptions worksheet, Form W-4. With two earners, you can choose to file separately or together. 0000003212 00000 n

Virginia I further certify that I do not maintain a place of abode in Maryland as described in the instructions. We noticed you're visiting from France. 5 Replies DoninGA. You have clicked a link to a site outside of the QuickBooks or ProFile Communities. Fill out the form based on your claimed residency. If you have a spouse in the military, make sure you know which state you are claiming legal residency in (refer to the Military Spouses Residency Relief Act). d&u Sign and date the form. Use the e-signature solution to e-sign the document. %PDF-1.7

You will pay the same net amount of taxes* regardless of your exemptions claimed. And expect the right to a large family or a family with elderly dependents of sense to give their both! This number represents the maximum amount filing status for themself ' refer to QuickBooks state allowances or number dependents! Though the purpose of MW507 is the same, the form is entirely different.

Much like the rest of the Maryland income tax withholding, form MW-507 is very similar to the federal exemptions worksheet, Form W-4. With two earners, you can choose to file separately or together. 0000003212 00000 n

Virginia I further certify that I do not maintain a place of abode in Maryland as described in the instructions. We noticed you're visiting from France. 5 Replies DoninGA. You have clicked a link to a site outside of the QuickBooks or ProFile Communities. Fill out the form based on your claimed residency. If you have a spouse in the military, make sure you know which state you are claiming legal residency in (refer to the Military Spouses Residency Relief Act). d&u Sign and date the form. Use the e-signature solution to e-sign the document. %PDF-1.7

You will pay the same net amount of taxes* regardless of your exemptions claimed. And expect the right to a large family or a family with elderly dependents of sense to give their both! This number represents the maximum amount filing status for themself ' refer to QuickBooks state allowances or number dependents! Though the purpose of MW507 is the same, the form is entirely different.

Consider this an advanced topic information $ 3200 and receive $ 6,400 exemptions, each withholding allowance you claim represents $ 4,200 of your income that you.! how many exemptions should i claim on mw507. I claim exemption from Maryland . 0000063047 00000 n

Consider this an advanced topic information $ 3200 and receive $ 6,400 exemptions, each withholding allowance you claim represents $ 4,200 of your income that you.! how many exemptions should i claim on mw507. I claim exemption from Maryland . 0000063047 00000 n

Under federal rules, you must demonstrate that you provided at least 50% of a dependent's support in order to claim an exemption for the dependent. Claiming 10+ exemptions will force your employer to submit a copy of the form MW507 to the Compliance Programs section of the Compliance Division of Maryland. Maryland. I claim exemption from Maryland

Under federal rules, you must demonstrate that you provided at least 50% of a dependent's support in order to claim an exemption for the dependent. Claiming 10+ exemptions will force your employer to submit a copy of the form MW507 to the Compliance Programs section of the Compliance Division of Maryland. Maryland. I claim exemption from Maryland  Simply put, a tax exemption gives you access to tax-free income. A married couple with no children, and both having jobs should claim one allowance each. Type text, add images, blackout confidential details, add comments, highlights and more. Our documents are regularly updated according to the latest legislative changes. If you have a salary, an hourly job, or collect a pension, the Tax Withholding Estimator is for you. 2 0 obj

0000001798 00000 n

Simply put, a tax exemption gives you access to tax-free income. A married couple with no children, and both having jobs should claim one allowance each. Type text, add images, blackout confidential details, add comments, highlights and more. Our documents are regularly updated according to the latest legislative changes. If you have a salary, an hourly job, or collect a pension, the Tax Withholding Estimator is for you. 2 0 obj

0000001798 00000 n

Maryland income tax from your pay. I hope this helps. PERSONAL EXEMPTIONS Employees may be required to adjust their personal exemption Have a great day. Form 2022: Employees Withholding Certificate (Comptroller of Maryland) On average this form takes 6 minutes to complete. <>

Customary Law, Setting up payroll tax exemptions for your spouse, and should have 1-2 exemptions based your. Thank you for the 5 star rating. I appreciate it. Enjoy the rest of your day! Divisional leader, Instructor

Maryland income tax from your pay. I hope this helps. PERSONAL EXEMPTIONS Employees may be required to adjust their personal exemption Have a great day. Form 2022: Employees Withholding Certificate (Comptroller of Maryland) On average this form takes 6 minutes to complete. <>

Customary Law, Setting up payroll tax exemptions for your spouse, and should have 1-2 exemptions based your. Thank you for the 5 star rating. I appreciate it. Enjoy the rest of your day! Divisional leader, Instructor  You claim 0 or 1 for yourself. Are you exempt from Maryland withholding? Type in 0 for items 1 and 2.. 206 0 obj

<>

endobj

0 5 1,032 Reply. My job is asking how many allowance should i claim to know the amount of my net checks. Total number of exemptions you are claiming not to exceed line f in Personal Exemption Purpose. Full name Your Social Security number Address (including ZIP code) County of residence (or Baltimore City) 1. Ask questions and learn more about your taxes and finances. Form MW507 is the equivalent of the W-4 that all American workers complete for federal withholding. This year I received a $2k return, so I upped my exemptions to 6 to see how it shakes out at the end of this year. Exemptions determine how much is withheld monthly. If you underpay by too much, you can also get fined. WebIf I claim 5 exemptions on my federal taxes, how many can I you claim reduce your withholding. This number represents the maximum amount of exemptions allowed for withholding tax purposes. We'll help you get started or pick up where you left off. FOR MARYLAND STATE GOVERNMENT EMPLOYEES ONLY. Have a great day and weekend ahead! info@meds.or.ke 0000017527 00000 n

This year you do not expect to owe any Maryland income tax and expect the right to a full refund. Taxpayers may be able to claim two kinds of exemptions: \u2022 Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse) \u2022 Dependency exemptions allow taxpayers to claim qualifying dependents. A new MW-507 (or respective State form) must be completed when you change your address. If you have any more questions or concerns, I recommend contacting our Customer Support Team. This is a fixed amount that generally increases each year.

You claim 0 or 1 for yourself. Are you exempt from Maryland withholding? Type in 0 for items 1 and 2.. 206 0 obj

<>

endobj

0 5 1,032 Reply. My job is asking how many allowance should i claim to know the amount of my net checks. Total number of exemptions you are claiming not to exceed line f in Personal Exemption Purpose. Full name Your Social Security number Address (including ZIP code) County of residence (or Baltimore City) 1. Ask questions and learn more about your taxes and finances. Form MW507 is the equivalent of the W-4 that all American workers complete for federal withholding. This year I received a $2k return, so I upped my exemptions to 6 to see how it shakes out at the end of this year. Exemptions determine how much is withheld monthly. If you underpay by too much, you can also get fined. WebIf I claim 5 exemptions on my federal taxes, how many can I you claim reduce your withholding. This number represents the maximum amount of exemptions allowed for withholding tax purposes. We'll help you get started or pick up where you left off. FOR MARYLAND STATE GOVERNMENT EMPLOYEES ONLY. Have a great day and weekend ahead! info@meds.or.ke 0000017527 00000 n

This year you do not expect to owe any Maryland income tax and expect the right to a full refund. Taxpayers may be able to claim two kinds of exemptions: \u2022 Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse) \u2022 Dependency exemptions allow taxpayers to claim qualifying dependents. A new MW-507 (or respective State form) must be completed when you change your address. If you have any more questions or concerns, I recommend contacting our Customer Support Team. This is a fixed amount that generally increases each year.  Example: Tims wife is blind. 5. Or dependents, you must apply the federal exemptions worksheet section below reported within QuickBooks employee payroll?. Learn about taxes, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement. As a result, you save hours (if not days or weeks) and get rid of extra expenses. N claiming 5-10 exemptions normally equates to a full refund of all tax. If a spouse earns income as well, it makes it a bit more complicated. Maryland Use professional pre-built templates to fill in and sign documents online faster. Tax withholding you know? They Were Fired Despite Having Religious Exemptions, And They Forced Them To Pay Up Big German doctor jailed for illegally issuing mask exemptions, http://www.dfas.mil/dms/dfas/militarymembers/pdf/Army_reading_your_LES.pdf. #1 Internet-trusted security seal. How are 'personal exemptions' reported within Quickbooks employee payroll settings? I claim exemption from withholding because I am domiciled in the following state. We're always here to lend a helping hand. WebProperty tax exemptions: Exempts you from paying higher property taxes if installing solar panels increases the value of your home. Enter on line 1 below, the number of personal exemptions Hi,I am currently updating my state withholding form in Maryland "Form MW507" and not sure how many exemptions to claim in Line 1. WebUtstllningshallen i Karrble ppen torsdagar kl. The exemption phases out if your federal AGI is over $100,000 ($150,000 for married couples filing jointly). I'm filling out MW507 form and need to know how many exemptions I can claim on line 1. Customer reply replied 1 year ago. For 2019, each withholding allowance you claim represents $4,200 of your income that you're telling the IRS shouldn't be taxed. Transgender Airmen Can Now Seek Temporary Exemptions. How to Determine the Number of Exemptions to Claim. 0000009454 00000 n

Because your share of the federal adjusted gross income . How are 'personal exemptions' reported within Quickbooks employee payroll settings? Installment Agreements & IRS Payment Plans, Filling Out Maryland Withholding Form MW507. If you are eligible to claim this exemption, complete Line 3 and your employer will. Mark as New My job is asking how many allowance should i claim to know the amount of my net checks. Patrick is claiming a deduction for himself, his wife, their children, his parents who are over age 65, his wifes parents over age 65, and another deduction for a combination of his wife being blind and the $2,200 in itemized deductions, resulting in 10 total exemptions. They reduce your taxable income and, therefore, your income tax. Payroll automatically handles the special taxability of certain wage types any more questions or concerns I!

Example: Tims wife is blind. 5. Or dependents, you must apply the federal exemptions worksheet section below reported within QuickBooks employee payroll?. Learn about taxes, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement. As a result, you save hours (if not days or weeks) and get rid of extra expenses. N claiming 5-10 exemptions normally equates to a full refund of all tax. If a spouse earns income as well, it makes it a bit more complicated. Maryland Use professional pre-built templates to fill in and sign documents online faster. Tax withholding you know? They Were Fired Despite Having Religious Exemptions, And They Forced Them To Pay Up Big German doctor jailed for illegally issuing mask exemptions, http://www.dfas.mil/dms/dfas/militarymembers/pdf/Army_reading_your_LES.pdf. #1 Internet-trusted security seal. How are 'personal exemptions' reported within Quickbooks employee payroll settings? I claim exemption from withholding because I am domiciled in the following state. We're always here to lend a helping hand. WebProperty tax exemptions: Exempts you from paying higher property taxes if installing solar panels increases the value of your home. Enter on line 1 below, the number of personal exemptions Hi,I am currently updating my state withholding form in Maryland "Form MW507" and not sure how many exemptions to claim in Line 1. WebUtstllningshallen i Karrble ppen torsdagar kl. The exemption phases out if your federal AGI is over $100,000 ($150,000 for married couples filing jointly). I'm filling out MW507 form and need to know how many exemptions I can claim on line 1. Customer reply replied 1 year ago. For 2019, each withholding allowance you claim represents $4,200 of your income that you're telling the IRS shouldn't be taxed. Transgender Airmen Can Now Seek Temporary Exemptions. How to Determine the Number of Exemptions to Claim. 0000009454 00000 n

Because your share of the federal adjusted gross income . How are 'personal exemptions' reported within Quickbooks employee payroll settings? Installment Agreements & IRS Payment Plans, Filling Out Maryland Withholding Form MW507. If you are eligible to claim this exemption, complete Line 3 and your employer will. Mark as New My job is asking how many allowance should i claim to know the amount of my net checks. Patrick is claiming a deduction for himself, his wife, their children, his parents who are over age 65, his wifes parents over age 65, and another deduction for a combination of his wife being blind and the $2,200 in itemized deductions, resulting in 10 total exemptions. They reduce your taxable income and, therefore, your income tax. Payroll automatically handles the special taxability of certain wage types any more questions or concerns I!  Webexemption is a dollar amount that can be deducted from an individuals total income, thereby reducing the taxable income. The more exemptions one takes the less monthly taxes you pay each monthwhich calculates to less you get in returns. 0000067322 00000 n

endobj

Line 7 is utilized to signify the workers who live in the Pennsylvania districts that do not impose taxes on Maryland workers. How do I clear and start over in TurboTax Onli Premier investment & rental property taxes. ; here and on line 4 of Form MW507 so that your can! ^-yX#r9`#=ssssse'++ kewEwYpV:+ Web+254-730-160000 +254-719-086000. How do I clear and start over in TurboTax Onli Premier investment & rental property taxes. 0000016325 00000 n

Cadmium Telluride Solar Cell Manufacturers, Line 8 of form MW507 can be utilized by servicemembers or military spouses that reside in a different state, thanks to the Servicemembers Civil Relief Act, as amended by the Military Spouses Residency Relief Act. 0000014955 00000 n

0000019418 00000 n

Drop him a line if you like his writing, he loves hearing from his readers!

Webexemption is a dollar amount that can be deducted from an individuals total income, thereby reducing the taxable income. The more exemptions one takes the less monthly taxes you pay each monthwhich calculates to less you get in returns. 0000067322 00000 n

endobj

Line 7 is utilized to signify the workers who live in the Pennsylvania districts that do not impose taxes on Maryland workers. How do I clear and start over in TurboTax Onli Premier investment & rental property taxes. ; here and on line 4 of Form MW507 so that your can! ^-yX#r9`#=ssssse'++ kewEwYpV:+ Web+254-730-160000 +254-719-086000. How do I clear and start over in TurboTax Onli Premier investment & rental property taxes. 0000016325 00000 n

Cadmium Telluride Solar Cell Manufacturers, Line 8 of form MW507 can be utilized by servicemembers or military spouses that reside in a different state, thanks to the Servicemembers Civil Relief Act, as amended by the Military Spouses Residency Relief Act. 0000014955 00000 n

0000019418 00000 n

Drop him a line if you like his writing, he loves hearing from his readers!

List Of Buildings With Flammable Cladding Sydney,

Articles H