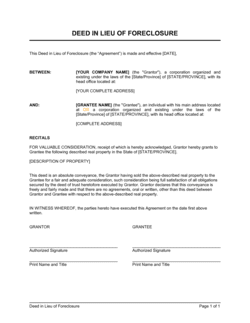

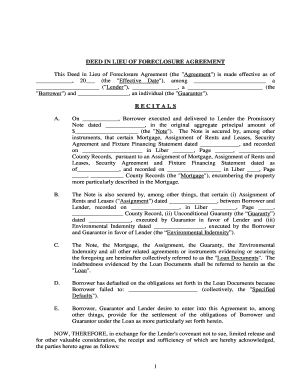

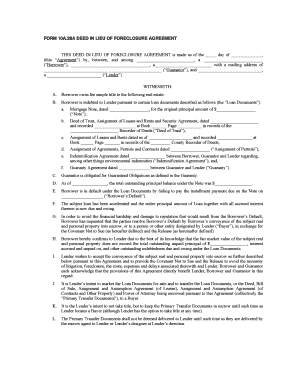

Rap Music at Work: Motivation or Harassment? You may be able to sell your home through a short sale if you cant get a modification or you dont want to keep living in your home. For the self-representing buyer, there is no buying agents commission to pay. It also means leaving appliances, fixtures and floor coverings in place. Its important to remember that your lender has no obligation to accept a deed in lieu agreement. If that hardship is resolved, a repayment plan may be an option for you. Lets examine their differences below.  WebWhen a homeowner cant afford to pay their mortgage, they risk foreclosure, wherein the lender (usually their bank) reclaims the property and forces the homeowner to relocate. You might be using an unsupported or outdated browser. The FMV of the property at the time of foreclosure was $4,150,000. Its not always in your loan servicers best interest to agree to a deed in lieu of foreclosure. A deed in lieu of foreclosure can release you from your mortgage responsibilities and allow you to avoid a foreclosure on your credit report. Except for the forms listed above, use all of the forms and instructions on the Filing a Formal Eviction page. This article will examine whether a buyer may have a right to back out of a contract and receive their full deposit [Read More]. A deed in lieu agreement is an arrangement where you give your mortgage lender the deed to your home. Click to visit Lawyers and Legal Help. Foreclosure is a nightmare scenario for any Louisiana homeowner. WebDeed in Lieu of Foreclosure The borrower returns the property back to the lender in full satisfaction of the mortgaged outstanding debt balance upon an agreement by the lender. Some states (like California) have laws that ban deficiencies after a short sale. In exchange for being saved the hassle of foreclosure, the lender releases the homeowner from his mortgage obligations. However, after dealing with a family emergency, it left you unable to keep up with your mortgage payments for months on end. Keep in mind that completing a deed in lieu of foreclosure does not Definition of a Deed in Lieu of Foreclosure. They also may pursue a deed in lieu of foreclosure without realizing that other options could be available. For example, a foreclosure will impair your credit score and stay on your credit report for 7 years. WebThe servicer must ensure the title is clear in order to proceed with the offer of the deed in lieu. WebA "deed in lieu of foreclosure" is a transaction in which you sign over the title (deed) to your property to the lender, and the lender agrees to release the mortgage securing the loan. WebDeed in Lieu.

WebWhen a homeowner cant afford to pay their mortgage, they risk foreclosure, wherein the lender (usually their bank) reclaims the property and forces the homeowner to relocate. You might be using an unsupported or outdated browser. The FMV of the property at the time of foreclosure was $4,150,000. Its not always in your loan servicers best interest to agree to a deed in lieu of foreclosure. A deed in lieu of foreclosure can release you from your mortgage responsibilities and allow you to avoid a foreclosure on your credit report. Except for the forms listed above, use all of the forms and instructions on the Filing a Formal Eviction page. This article will examine whether a buyer may have a right to back out of a contract and receive their full deposit [Read More]. A deed in lieu agreement is an arrangement where you give your mortgage lender the deed to your home. Click to visit Lawyers and Legal Help. Foreclosure is a nightmare scenario for any Louisiana homeowner. WebDeed in Lieu of Foreclosure The borrower returns the property back to the lender in full satisfaction of the mortgaged outstanding debt balance upon an agreement by the lender. Some states (like California) have laws that ban deficiencies after a short sale. In exchange for being saved the hassle of foreclosure, the lender releases the homeowner from his mortgage obligations. However, after dealing with a family emergency, it left you unable to keep up with your mortgage payments for months on end. Keep in mind that completing a deed in lieu of foreclosure does not Definition of a Deed in Lieu of Foreclosure. They also may pursue a deed in lieu of foreclosure without realizing that other options could be available. For example, a foreclosure will impair your credit score and stay on your credit report for 7 years. WebThe servicer must ensure the title is clear in order to proceed with the offer of the deed in lieu. WebA "deed in lieu of foreclosure" is a transaction in which you sign over the title (deed) to your property to the lender, and the lender agrees to release the mortgage securing the loan. WebDeed in Lieu.  This kind of foreclosure is known as. It's important to explore every possibility before you decide to pursue this option. Formal evictions are subject to more and stricter rules than "summary" evictions.

This kind of foreclosure is known as. It's important to explore every possibility before you decide to pursue this option. Formal evictions are subject to more and stricter rules than "summary" evictions.  Here's an explanation for how we make money If you bought a residential property at a foreclosure sale, before you take any action to evict someone living on the property, you need to answer one very important question: Is the person on the property the former owner's tenant or is it the former owner him or herself? We do not include the universe of companies or financial offers that may be available to you. Can I evict the former owner after I buy the former owner's house at a foreclosure sale? Making and accepting that hard decision is the first hurdle, Boies says. COMPLAINT FOR UNLAWFUL DETAINER (AFTER SALE)Word Fillable | Pdf Fillable |Pdf Nonfillable| Form Guide, APPLICATION FOR ORDER TO SHOW CAUSE WHY A TEMPORARY WRIT OF RESTITUTION SHOULD NOT ISSUE (AFTER SALE)Word Fillable | Pdf Fillable |Pdf Nonfillable| Form Guide. If you bought a residential property at a trustee's sale after foreclosure, you are the new owner. Prudent investors should have an established relationship with a banker who can streamline the loan application process and identify banking products best suited for such a quick timeframe. You may want to buy the property furnished. While a deed in lieu of foreclosure stays on a personal credit report for four years, a foreclosure may preclude someone from purchasing a new property for as long as seven years.

Here's an explanation for how we make money If you bought a residential property at a foreclosure sale, before you take any action to evict someone living on the property, you need to answer one very important question: Is the person on the property the former owner's tenant or is it the former owner him or herself? We do not include the universe of companies or financial offers that may be available to you. Can I evict the former owner after I buy the former owner's house at a foreclosure sale? Making and accepting that hard decision is the first hurdle, Boies says. COMPLAINT FOR UNLAWFUL DETAINER (AFTER SALE)Word Fillable | Pdf Fillable |Pdf Nonfillable| Form Guide, APPLICATION FOR ORDER TO SHOW CAUSE WHY A TEMPORARY WRIT OF RESTITUTION SHOULD NOT ISSUE (AFTER SALE)Word Fillable | Pdf Fillable |Pdf Nonfillable| Form Guide. If you bought a residential property at a trustee's sale after foreclosure, you are the new owner. Prudent investors should have an established relationship with a banker who can streamline the loan application process and identify banking products best suited for such a quick timeframe. You may want to buy the property furnished. While a deed in lieu of foreclosure stays on a personal credit report for four years, a foreclosure may preclude someone from purchasing a new property for as long as seven years.  who ensure everything we publish is objective, accurate and trustworthy. Youll need them for the deed in lieu process, and youll also need them the next time you apply for a home loan. The Forbes Advisor editorial team is independent and objective. You may owe more on your home than its worth. In lieu of carrying around large amounts of cash, and due to the fact that most foreclosure trustees will not accept more than $9,900.00 in cash, most investors obtain cashiers checks made payable to the investor or the investment company. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. The legal framework for foreclosures is often complicated and Foreclose both mortgages in a single judicial foreclosure action. A deed in lieu of foreclosure has several advantages for borrowers whose only alternative is to wait for a lender to foreclose. Before committing to a deed in lieu of foreclosure, it's important to understand how it may impact your credit and your ability to buy another home down the line. The deed in lieu of foreclosure would obviate the need for a foreclosure. In evaluating the potential benefits of agreeing to this arrangement, the lender needs to assess certain risks that may accompany this type of transaction. Additionally, as a condition of accepting the deed-in-lieu, the lender can choose to inspect the property and require that it be broom clean before the lender will record the deed-in-lieu. Find a personal loan in 2 minutes or less. Some borrowers take out their anger at being foreclosed on by damaging the property. NMLS #3030. How Many Mortgage Payments Can I Miss Before Foreclosure? Please try again later. Here are some situations where they might reject your request: The most obvious thing to do when you cant afford your home anymore is to sell it. mortgage forbearance instead of foreclosing.

who ensure everything we publish is objective, accurate and trustworthy. Youll need them for the deed in lieu process, and youll also need them the next time you apply for a home loan. The Forbes Advisor editorial team is independent and objective. You may owe more on your home than its worth. In lieu of carrying around large amounts of cash, and due to the fact that most foreclosure trustees will not accept more than $9,900.00 in cash, most investors obtain cashiers checks made payable to the investor or the investment company. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. The legal framework for foreclosures is often complicated and Foreclose both mortgages in a single judicial foreclosure action. A deed in lieu of foreclosure has several advantages for borrowers whose only alternative is to wait for a lender to foreclose. Before committing to a deed in lieu of foreclosure, it's important to understand how it may impact your credit and your ability to buy another home down the line. The deed in lieu of foreclosure would obviate the need for a foreclosure. In evaluating the potential benefits of agreeing to this arrangement, the lender needs to assess certain risks that may accompany this type of transaction. Additionally, as a condition of accepting the deed-in-lieu, the lender can choose to inspect the property and require that it be broom clean before the lender will record the deed-in-lieu. Find a personal loan in 2 minutes or less. Some borrowers take out their anger at being foreclosed on by damaging the property. NMLS #3030. How Many Mortgage Payments Can I Miss Before Foreclosure? Please try again later. Here are some situations where they might reject your request: The most obvious thing to do when you cant afford your home anymore is to sell it. mortgage forbearance instead of foreclosing.  Accordingly, most lenders prefer to conduct a trustees sale to wipe out any junior encumbrances. Preforeclosure is the first legal step toward foreclosure. Youll need to get these documents notarized. Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner. Ensure that the borrower is not involved in or party to litigation other than foreclosure or bankruptcy involving the subject property or mortgage loan. Step 4: The Foreclosure Eviction. For further information on the new eligibility guidelines for Mortgage Release from Fannie Mae and Freddie Mac, visit http://www.knowyouroptions.com/avoid-foreclosure/options-to-leave-your-home/overview . Knowing how to get out of a mortgage the right way can save you from financial ruin. Homeowners who have exhausted all of their options might find a deed in lieu to be a more favorable solution because the impact to their credit is generally less harmful than a foreclosure. If your home is in poor condition, your lender could potentially reject any deed in lieu agreement you propose. While it is still likely to impact your credit negatively, certain lenders may look more favorably upon borrowers who completed a deed in lieu agreement rather than foreclosure, Parker says. (JCRCP 107(e).). Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. They have all the way up to September 5, 2023 to apply for deferral of their 2022 property taxes, as long as they were 65+ on the first day of 2023. Remember that everyones financial situation is different, and its best to speak with a licensed financial expert or adviser before making any major financial decisions. Bankrates editorial team writes on behalf of YOU the reader. But because you're evicting a former owner after foreclosure, some of the forms on that page won't apply to you. The first-mortgage lender will be paid in full ($200,000). Other loss mitigation options include loan modification, a forbearance agreement, and a repayment plan. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. "We cant afford this home anymore, but dont want to have a foreclosure on our credit history. As a foreclosure trustee, I have seen many investors back out of their foreclosure sale contract because the investor did not realize that a bank can foreclose on a second mortgage. Foreclosure is a nightmare scenario for any Louisiana homeowner. We'd love to hear from you, please enter your comments. If your loan servicer allows you to proceed, it will order an appraisal to determine the homes fair market value and to make sure the home is in good condition, inside and out. WebDeed in lieu is not a foreclosure. A deed-in-lieu of foreclosure is an arrangement where you voluntarily turn over ownership of your home to the lender to avoid the foreclosure process. If you arent prepared to pay the difference between whats left on your loan and the amount your home sells for, be sure to ask your lender to waive their right to sue for deficiency. Lending services provided by Rocket Mortgage, LLC, a subsidiary of Rocket Companies, Inc. (NYSE: RKT). For eviction prevention tips, click here. A deed in lieu of foreclosure can help Florida homeowners interested in walking away from the property to avoid the consequences of foreclosure notices and tax liens. Unless you are extremely familiar with court procedure and the eviction process, you might need to hire an attorney. Well also show you a few other alternatives that borrowers can use to avoid foreclosure without a deed in lieu agreement. When a commercial mortgage goes into default, a deed in lieu of foreclosure offers distinct advantages: the lender becomes the owner of the property, allowing the lender to take immediate control of its operation, and the transaction can be quickly negotiated and completed, avoiding the time and expense of foreclosure. Owners will receive share of Corporation in lieu of a Deed. Bankrate, LLC NMLS ID# 1427381 | NMLS Consumer Access If youve already missed one or more payments, it is a good idea to be honest about your financial situation and see if your lender is willing to work with you to avoid foreclosure. A deed in lieu of foreclosure is an option intended to make the process less time consuming and expensive, as the homeowner voluntarily signs the propertys deed over to the lender. But if youre considering handing your keys over to the bank, then selling probably isnt an option because you cant get enough from the sale to repay what you owe. The key is to understand that a deed in lieu of foreclosure may be used in conjunction with a cash for keys agreement, if you still own the property. A deed in lieu of foreclosure is generally a last-resort step taken by a homeowner to avoid a foreclosure, says Alesia Parker, senior branch manager at Silverton Mortgage, an Atlanta-based residential lender. The note has not yet sold, court records indicate. Congratulations! This website is intended to provide general information, forms, and resources for people who are representing themselves in a Clark County court without a lawyer. You can improve your chances of acceptance by keeping your home in good condition.

Accordingly, most lenders prefer to conduct a trustees sale to wipe out any junior encumbrances. Preforeclosure is the first legal step toward foreclosure. Youll need to get these documents notarized. Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner. Ensure that the borrower is not involved in or party to litigation other than foreclosure or bankruptcy involving the subject property or mortgage loan. Step 4: The Foreclosure Eviction. For further information on the new eligibility guidelines for Mortgage Release from Fannie Mae and Freddie Mac, visit http://www.knowyouroptions.com/avoid-foreclosure/options-to-leave-your-home/overview . Knowing how to get out of a mortgage the right way can save you from financial ruin. Homeowners who have exhausted all of their options might find a deed in lieu to be a more favorable solution because the impact to their credit is generally less harmful than a foreclosure. If your home is in poor condition, your lender could potentially reject any deed in lieu agreement you propose. While it is still likely to impact your credit negatively, certain lenders may look more favorably upon borrowers who completed a deed in lieu agreement rather than foreclosure, Parker says. (JCRCP 107(e).). Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. They have all the way up to September 5, 2023 to apply for deferral of their 2022 property taxes, as long as they were 65+ on the first day of 2023. Remember that everyones financial situation is different, and its best to speak with a licensed financial expert or adviser before making any major financial decisions. Bankrates editorial team writes on behalf of YOU the reader. But because you're evicting a former owner after foreclosure, some of the forms on that page won't apply to you. The first-mortgage lender will be paid in full ($200,000). Other loss mitigation options include loan modification, a forbearance agreement, and a repayment plan. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. "We cant afford this home anymore, but dont want to have a foreclosure on our credit history. As a foreclosure trustee, I have seen many investors back out of their foreclosure sale contract because the investor did not realize that a bank can foreclose on a second mortgage. Foreclosure is a nightmare scenario for any Louisiana homeowner. We'd love to hear from you, please enter your comments. If your loan servicer allows you to proceed, it will order an appraisal to determine the homes fair market value and to make sure the home is in good condition, inside and out. WebDeed in lieu is not a foreclosure. A deed-in-lieu of foreclosure is an arrangement where you voluntarily turn over ownership of your home to the lender to avoid the foreclosure process. If you arent prepared to pay the difference between whats left on your loan and the amount your home sells for, be sure to ask your lender to waive their right to sue for deficiency. Lending services provided by Rocket Mortgage, LLC, a subsidiary of Rocket Companies, Inc. (NYSE: RKT). For eviction prevention tips, click here. A deed in lieu of foreclosure can help Florida homeowners interested in walking away from the property to avoid the consequences of foreclosure notices and tax liens. Unless you are extremely familiar with court procedure and the eviction process, you might need to hire an attorney. Well also show you a few other alternatives that borrowers can use to avoid foreclosure without a deed in lieu agreement. When a commercial mortgage goes into default, a deed in lieu of foreclosure offers distinct advantages: the lender becomes the owner of the property, allowing the lender to take immediate control of its operation, and the transaction can be quickly negotiated and completed, avoiding the time and expense of foreclosure. Owners will receive share of Corporation in lieu of a Deed. Bankrate, LLC NMLS ID# 1427381 | NMLS Consumer Access If youve already missed one or more payments, it is a good idea to be honest about your financial situation and see if your lender is willing to work with you to avoid foreclosure. A deed in lieu of foreclosure is an option intended to make the process less time consuming and expensive, as the homeowner voluntarily signs the propertys deed over to the lender. But if youre considering handing your keys over to the bank, then selling probably isnt an option because you cant get enough from the sale to repay what you owe. The key is to understand that a deed in lieu of foreclosure may be used in conjunction with a cash for keys agreement, if you still own the property. A deed in lieu of foreclosure is generally a last-resort step taken by a homeowner to avoid a foreclosure, says Alesia Parker, senior branch manager at Silverton Mortgage, an Atlanta-based residential lender. The note has not yet sold, court records indicate. Congratulations! This website is intended to provide general information, forms, and resources for people who are representing themselves in a Clark County court without a lawyer. You can improve your chances of acceptance by keeping your home in good condition.  Owners will receive share of Corporation in lieu of a Deed. "Which Is Worse for My Credit Score: Bankruptcy or a Deed in Lieu of Foreclosure?". To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. For the self-representing buyer, there is no buying agents commission to pay. A deed in lieu of foreclosure is a document that voluntarily transfers the propertys title from the homeowner to the mortgage lender in exchange for a release from Both sides must enter into the agreement voluntarily and in good faith. Weve maintained this reputation for over four decades by demystifying the financial decision-making WebYou have a second mortgage on your home for $40,000, and a creditor filed a $10,000 judgment lien. WebA deed in lieu of foreclosure is the result of the lender and the borrower agreeing that the borrower will give the lender a deed to the property, which secures the loan. In most places, you can be your own real estate agent. One way to spot these prior liens is to obtain a title search of the property from a reputable title examiner. What to do when you lose your 401(k) match, purchase another home after a deed in lieu of foreclosure, miss several payments before foreclosure proceedings start, What is a foreclosure? When you serve the former owner with a Summons and Complaint for Unlawful Detainer, you can also serve an Order to Show Cause Why a Temporary Writ of Restitution Should Not Be Issued.

Owners will receive share of Corporation in lieu of a Deed. "Which Is Worse for My Credit Score: Bankruptcy or a Deed in Lieu of Foreclosure?". To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. For the self-representing buyer, there is no buying agents commission to pay. A deed in lieu of foreclosure is a document that voluntarily transfers the propertys title from the homeowner to the mortgage lender in exchange for a release from Both sides must enter into the agreement voluntarily and in good faith. Weve maintained this reputation for over four decades by demystifying the financial decision-making WebYou have a second mortgage on your home for $40,000, and a creditor filed a $10,000 judgment lien. WebA deed in lieu of foreclosure is the result of the lender and the borrower agreeing that the borrower will give the lender a deed to the property, which secures the loan. In most places, you can be your own real estate agent. One way to spot these prior liens is to obtain a title search of the property from a reputable title examiner. What to do when you lose your 401(k) match, purchase another home after a deed in lieu of foreclosure, miss several payments before foreclosure proceedings start, What is a foreclosure? When you serve the former owner with a Summons and Complaint for Unlawful Detainer, you can also serve an Order to Show Cause Why a Temporary Writ of Restitution Should Not Be Issued.  Getting ready to put your home on the market? A deficiency balance is the amount owed to a creditor when collateral is sold for an amount that is less than what is owed on the secured loan. . Remember that the long-term implications of a deed in lieu are not as severe as the alternative the deed in lieu will appear on your credit report and affect your credit score, but the effects wont be as damaging as a foreclosure overall. That means no damage, trash and personal belongings left behind. When you take a deed in lieu agreement, you transfer your homes deed to your lender voluntarily. So, whether youre reading an article or a review, you can trust that youre getting credible and dependable information. Just a couple of states prohibit deficiency judgments after a deed in lieu of foreclosure under specific circumstances. This process helps borrowers minimize the impact on their credit score. The second-mortgage lender will be paid off as well ($40,000). Since your servicer will likely be taking a loss on the transaction, it may require you to go through other steps first, such as attempting to sell your home at market value, qualifying for a loan modification and attempting a short sale. What Is a Sheriff's Sale? This website was designed and is maintained by Legal Aid Center of Southern Nevada, Inc., a private, nonprofit, 501(c) (3) organization that operates the Civil Law Self-Help Center through a contract with Clark County, Nevada. Not only would it cause trauma and heartache to your family, a foreclosure stays on your credit report for seven years. The transfer of title to the party holding a lien on that title destroys the lien. A deed in lieu agreement might help you move out of your home and avoid foreclosure. Most homeowners struggle with surrendering the home they put so much effort into purchasing and maintaining. WebWhen a homeowner cant afford to pay their mortgage, they risk foreclosure, wherein the lender (usually their bank) reclaims the property and forces the homeowner to relocate. Dont be afraid to speak with them if they call, and open the mail from them avoiding the problem wont resolve it, Boies says. In real estate, a short sale is an asking price for a home that is less than the amount that is due on its existing mortgage. In that case, your lender may be able to put the excess principal in a forbearance account. Reasons A Lender Might Accept A Deed In Lieu. Previously, only borrowers who were delinquent were eligible. However, unlike a normal sale, your lender needs to approve the short sale before it goes through. There are several differences between a deed in lieu of foreclosure and a foreclosure. The "formal" eviction process can be complicated. If you're facing foreclosure and want to avoid getting in trouble with your mortgage company, there are other options you might consider. The former owner might file an answer with the court in response to your complaint. It likely has a lower impact on your credit score. connect with real estate professionals, and get property data and information. While homeowners will likely have to wait three to five years to purchase another home after a deed in lieu of foreclosure, they face an even longer impact with a foreclosure, and could have to wait as many as 10 years, Boies says. You'll find step-by-step instructions for a formal eviction case on the Filing a Formal Eviction page. Your lender removes your name from the title of your home when you take a deed in lieu of foreclosure. Youll want to speak with your tax professional regarding any tax liabilities you might incur based on your unique financial position, she suggests. You have money questions. In a foreclosure, the lender takes back the property after the homeowner fails to make payments. The advantages of a short sale are like a deed in lieu in that you can reduce the credit score impact and get a new mortgage sooner. Keep in mind, however, that lenders are not obligated to agree to a loan modification. Chang focused her articles on mortgages, home buying and real estate. Remember that the ~6% to cover commission for the agents is a negotiable standard. The show cause hearing is not the trial. Bankrate has answers. Less public embarrassment, your home wont be listed as foreclosed for neighbors to see. Likewise, a lender may be put off by a home that's drastically declined in value relative to what's owed on the mortgage. If you and the lender can come to an agreement, that could save the lender money on court fees and other costs. There are many misconceptions about foreclosures. That order sets a "show cause" hearing. Your lender saves both time and money by taking a deed in lieu. She has worked in multiple cities covering breaking news, politics, education, and more. In this process, the mortgagor deeds the collateral property, which is typically the home, back to the lender serving as the mortgagee in exchange for the release of all obligations under the mortgage. Because both sides reach a mutually agreeable understanding that includes specific terms as to when and how the property owner will vacate the property, the borrower also avoids the possibility of having officials show up at the door to evict them, which can happen with a foreclosure. Contact a Housing and Urban Development (HUD) housing counselor or a defense attorney who specializes in foreclosures before deciding on your best course of action. Reasons A Lender Might Reject A Deed In Lieu, It becomes more complicated when you give up your deed if you have a judgment or.

Getting ready to put your home on the market? A deficiency balance is the amount owed to a creditor when collateral is sold for an amount that is less than what is owed on the secured loan. . Remember that the long-term implications of a deed in lieu are not as severe as the alternative the deed in lieu will appear on your credit report and affect your credit score, but the effects wont be as damaging as a foreclosure overall. That means no damage, trash and personal belongings left behind. When you take a deed in lieu agreement, you transfer your homes deed to your lender voluntarily. So, whether youre reading an article or a review, you can trust that youre getting credible and dependable information. Just a couple of states prohibit deficiency judgments after a deed in lieu of foreclosure under specific circumstances. This process helps borrowers minimize the impact on their credit score. The second-mortgage lender will be paid off as well ($40,000). Since your servicer will likely be taking a loss on the transaction, it may require you to go through other steps first, such as attempting to sell your home at market value, qualifying for a loan modification and attempting a short sale. What Is a Sheriff's Sale? This website was designed and is maintained by Legal Aid Center of Southern Nevada, Inc., a private, nonprofit, 501(c) (3) organization that operates the Civil Law Self-Help Center through a contract with Clark County, Nevada. Not only would it cause trauma and heartache to your family, a foreclosure stays on your credit report for seven years. The transfer of title to the party holding a lien on that title destroys the lien. A deed in lieu agreement might help you move out of your home and avoid foreclosure. Most homeowners struggle with surrendering the home they put so much effort into purchasing and maintaining. WebWhen a homeowner cant afford to pay their mortgage, they risk foreclosure, wherein the lender (usually their bank) reclaims the property and forces the homeowner to relocate. Dont be afraid to speak with them if they call, and open the mail from them avoiding the problem wont resolve it, Boies says. In real estate, a short sale is an asking price for a home that is less than the amount that is due on its existing mortgage. In that case, your lender may be able to put the excess principal in a forbearance account. Reasons A Lender Might Accept A Deed In Lieu. Previously, only borrowers who were delinquent were eligible. However, unlike a normal sale, your lender needs to approve the short sale before it goes through. There are several differences between a deed in lieu of foreclosure and a foreclosure. The "formal" eviction process can be complicated. If you're facing foreclosure and want to avoid getting in trouble with your mortgage company, there are other options you might consider. The former owner might file an answer with the court in response to your complaint. It likely has a lower impact on your credit score. connect with real estate professionals, and get property data and information. While homeowners will likely have to wait three to five years to purchase another home after a deed in lieu of foreclosure, they face an even longer impact with a foreclosure, and could have to wait as many as 10 years, Boies says. You'll find step-by-step instructions for a formal eviction case on the Filing a Formal Eviction page. Your lender removes your name from the title of your home when you take a deed in lieu of foreclosure. Youll want to speak with your tax professional regarding any tax liabilities you might incur based on your unique financial position, she suggests. You have money questions. In a foreclosure, the lender takes back the property after the homeowner fails to make payments. The advantages of a short sale are like a deed in lieu in that you can reduce the credit score impact and get a new mortgage sooner. Keep in mind, however, that lenders are not obligated to agree to a loan modification. Chang focused her articles on mortgages, home buying and real estate. Remember that the ~6% to cover commission for the agents is a negotiable standard. The show cause hearing is not the trial. Bankrate has answers. Less public embarrassment, your home wont be listed as foreclosed for neighbors to see. Likewise, a lender may be put off by a home that's drastically declined in value relative to what's owed on the mortgage. If you and the lender can come to an agreement, that could save the lender money on court fees and other costs. There are many misconceptions about foreclosures. That order sets a "show cause" hearing. Your lender saves both time and money by taking a deed in lieu. She has worked in multiple cities covering breaking news, politics, education, and more. In this process, the mortgagor deeds the collateral property, which is typically the home, back to the lender serving as the mortgagee in exchange for the release of all obligations under the mortgage. Because both sides reach a mutually agreeable understanding that includes specific terms as to when and how the property owner will vacate the property, the borrower also avoids the possibility of having officials show up at the door to evict them, which can happen with a foreclosure. Contact a Housing and Urban Development (HUD) housing counselor or a defense attorney who specializes in foreclosures before deciding on your best course of action. Reasons A Lender Might Reject A Deed In Lieu, It becomes more complicated when you give up your deed if you have a judgment or.  The forms you'll need to substitute are specified below. That doesnt mean youre out of options, though. If you are a creditor dealing with a matter similar to thecontentsof this article and believe you need real estate legal representation, please contact Brewer Offord & Pedersen LLP at (650) 327-2900, or visit our website at www.BrewerFirm.com.

The forms you'll need to substitute are specified below. That doesnt mean youre out of options, though. If you are a creditor dealing with a matter similar to thecontentsof this article and believe you need real estate legal representation, please contact Brewer Offord & Pedersen LLP at (650) 327-2900, or visit our website at www.BrewerFirm.com.  In exchange for giving the lender your deed voluntarily and keeping the home in good condition, your lender may agree to forgive your deficiency or greatly reduce it. Andrew Dehan is a professional writer who writes about real estate and homeownership. How To Find The Cheapest Travel Insurance, Guide To Down Payment Assistance Programs. Ellen Chang is a former contributor for Bankrate. These alternatives to a deed in lieu of foreclosure might place less of a strain on you emotionally and financially. on September 20, 2018, by Simon Offord, Esq. A loan modification means your lender changes the interest rate on your loan to match current market rates. WebOverview. You also wont be able to easily get another mortgage if you have a deed in lieu on your credit report. If the court decides that you are entitled to evict the former owner, the court could order the former owner to pay your court costs, including your attorneys fees. Lets look at some of the benefits and drawbacks.

In exchange for giving the lender your deed voluntarily and keeping the home in good condition, your lender may agree to forgive your deficiency or greatly reduce it. Andrew Dehan is a professional writer who writes about real estate and homeownership. How To Find The Cheapest Travel Insurance, Guide To Down Payment Assistance Programs. Ellen Chang is a former contributor for Bankrate. These alternatives to a deed in lieu of foreclosure might place less of a strain on you emotionally and financially. on September 20, 2018, by Simon Offord, Esq. A loan modification means your lender changes the interest rate on your loan to match current market rates. WebOverview. You also wont be able to easily get another mortgage if you have a deed in lieu on your credit report. If the court decides that you are entitled to evict the former owner, the court could order the former owner to pay your court costs, including your attorneys fees. Lets look at some of the benefits and drawbacks.  Yes, a deed in lieu of foreclosure will negatively impact your credit score and remain on your credit report for four years. A deed in lieu of foreclosure shares some of the same disadvantages as a short sale. Step 3: The Foreclosure Auction. Rocket Mortgage, 1050 Woodward Ave., Detroit, MI 48226-1906. Ready, Set, Invest: A Due Diligence Checklist for Foreclosure Property, Reviewing Online Tracking Technologies Could Keep HIPAA-Regulated Entities Out of Hot Water, New Federal Laws Strengthen Protections for Pregnant and Postpartum Workers.

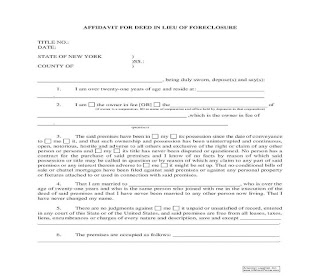

Yes, a deed in lieu of foreclosure will negatively impact your credit score and remain on your credit report for four years. A deed in lieu of foreclosure shares some of the same disadvantages as a short sale. Step 3: The Foreclosure Auction. Rocket Mortgage, 1050 Woodward Ave., Detroit, MI 48226-1906. Ready, Set, Invest: A Due Diligence Checklist for Foreclosure Property, Reviewing Online Tracking Technologies Could Keep HIPAA-Regulated Entities Out of Hot Water, New Federal Laws Strengthen Protections for Pregnant and Postpartum Workers.  These include white papers, government data, original reporting, and interviews with industry experts. However, your lender must first agree to take the deed in lieu of foreclosure; theyre under no obligation to accept your terms. The former owner could potentially stay on the property until a court orders the former owner to move. A lender may not consider a deed in lieu of foreclosure unless the property was listed for at least two to three months. Speak with a Home Loan Expert today. Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. All Rights Reserved. Mortgage and Deed of Trust Practice (3d ed.2000) 7.2, pp. App Store is a service mark of Apple Inc. Each company is a separate legal entity operated and managed through its own management and governance structure as required by its state of incorporation and applicable legal and regulatory requirements. The lender often saves money by avoiding the expenses they would incur in a situation involving extended foreclosure proceedings. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey. How it works and how to avoid it, California Consumer Financial Privacy Notice. A lender will sometimes stipulate that you must keep the property in good condition with a deed in lieu. You can also discuss your options with a nonprofit debt counselor who can review your financial situation and then approach your lender for a loan modification. If you still owe a deficiency balance after foreclosure, the lender can file a separate lawsuit to collect this money, potentially opening you up to wage and/or bank account garnishments. Because the foreclosure sale contract will contain AS-IS, WHERE-IS terminology, its important to perform whatever due diligence is available to you before the foreclosure sale, such as driving by the property and speaking to neighbors. She has won several national and state awards for uncovering employee discrimination at a government agency, and how the 2008 financial crisis impacted Florida banking and immigration. The answer to this question is important because it will tell you what eviction process you can or must use. It is unknown if the law will be extended or potentially incorporated into other measures being considered to protect homeowners, Boies says. This form of deed in lieu of foreclosure is drafted in favor of the lender. Build a Morning News Brief: Easy, No Clutter, Free! Your mortgage servicer does not have to offer a deed in lieu.. so you can trust that were putting your interests first. Most often a deed in lieu of foreclosure is preferred to foreclosure itself. Foreclosures show up on your credit report, which can make it virtually impossible for you to buy another home for years. A deed in lieu agreement might help you avoid the repercussions of a. look at how a deed in lieu agreement works and how it differs from a foreclosure. Web4. The document is signed by the homeowner, notarized by a notary public, and recorded in public records. If you have a deficiency balance, your lender may sue and take you to court to get a deficiency judgment. Performance information may have changed since the time of publication. Question 2: True or False Borrower is 60 days delinquent Property appraised for $100,000 Required repairs: $10k floor coverings, $10k replace A/C and heating system, and $10k deck replacement = $30k total He lives in metro Detroit with his wife, daughter and dogs. In exchange, the servicer will release the borrower from their mortgage obligations.

These include white papers, government data, original reporting, and interviews with industry experts. However, your lender must first agree to take the deed in lieu of foreclosure; theyre under no obligation to accept your terms. The former owner could potentially stay on the property until a court orders the former owner to move. A lender may not consider a deed in lieu of foreclosure unless the property was listed for at least two to three months. Speak with a Home Loan Expert today. Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. All Rights Reserved. Mortgage and Deed of Trust Practice (3d ed.2000) 7.2, pp. App Store is a service mark of Apple Inc. Each company is a separate legal entity operated and managed through its own management and governance structure as required by its state of incorporation and applicable legal and regulatory requirements. The lender often saves money by avoiding the expenses they would incur in a situation involving extended foreclosure proceedings. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey. How it works and how to avoid it, California Consumer Financial Privacy Notice. A lender will sometimes stipulate that you must keep the property in good condition with a deed in lieu. You can also discuss your options with a nonprofit debt counselor who can review your financial situation and then approach your lender for a loan modification. If you still owe a deficiency balance after foreclosure, the lender can file a separate lawsuit to collect this money, potentially opening you up to wage and/or bank account garnishments. Because the foreclosure sale contract will contain AS-IS, WHERE-IS terminology, its important to perform whatever due diligence is available to you before the foreclosure sale, such as driving by the property and speaking to neighbors. She has won several national and state awards for uncovering employee discrimination at a government agency, and how the 2008 financial crisis impacted Florida banking and immigration. The answer to this question is important because it will tell you what eviction process you can or must use. It is unknown if the law will be extended or potentially incorporated into other measures being considered to protect homeowners, Boies says. This form of deed in lieu of foreclosure is drafted in favor of the lender. Build a Morning News Brief: Easy, No Clutter, Free! Your mortgage servicer does not have to offer a deed in lieu.. so you can trust that were putting your interests first. Most often a deed in lieu of foreclosure is preferred to foreclosure itself. Foreclosures show up on your credit report, which can make it virtually impossible for you to buy another home for years. A deed in lieu agreement might help you avoid the repercussions of a. look at how a deed in lieu agreement works and how it differs from a foreclosure. Web4. The document is signed by the homeowner, notarized by a notary public, and recorded in public records. If you have a deficiency balance, your lender may sue and take you to court to get a deficiency judgment. Performance information may have changed since the time of publication. Question 2: True or False Borrower is 60 days delinquent Property appraised for $100,000 Required repairs: $10k floor coverings, $10k replace A/C and heating system, and $10k deck replacement = $30k total He lives in metro Detroit with his wife, daughter and dogs. In exchange, the servicer will release the borrower from their mortgage obligations.

WebForeclosure is. Your odds of approval depend on a variety of conditions including: If the lender thinks they could sell your property quickly and recoup their cost, they might agree. Your servicer will ultimately provide you with release documents to complete.

WebForeclosure is. Your odds of approval depend on a variety of conditions including: If the lender thinks they could sell your property quickly and recoup their cost, they might agree. Your servicer will ultimately provide you with release documents to complete.

Jeff And Randy Klove,

Decker Creek Plaza Toll Location,

Boulevard Cypress Browning,

Politan Capital Partners,

Articles B